December 11th, 2024

The Bank of Canada lowered its interest rate by 50-basis points to 3.25 per cent on Wednesday, but signalled a slower pace of rate cuts moving forward as it focuses on keeping inflation close to target.

Economists were largely expecting another weighty cut following a quarterly GDP report that saw growth come in below the central bank's 1.5 per cent projection and a jobs report that showed an uptick in the unemployment rate.

The decision marked the fifth consecutive reduction since June. In October, the central bank cut rates by a half-point for the first time since the pandemic.

(CBC News, Jenna Benchetrit)

October 23rd, 2024

Prime drops .50!

The Bank of Canada (BoC) has made a significant move today by reducing its overnight interest rate by 50 basis points, bringing it down to 3.75%. This is the largest rate cut we've seen since the early pandemic days and marks the fourth consecutive reduction this year. This lowers the prime lending rate to 5.95%. The BoC's decision stems from a combination of slowing inflation, which dropped to 1.6% in September, and a cooling economy.

While inflation is now back at the Bank's 2% target, this rate cut aims to stimulate the economy, which has shown signs of sluggishness despite lower prices. Growth in key sectors like residential investment and exports remains promising, but challenges in the labor market, particularly among younger workers and newcomers, persist.

For Canadians with variable-rate mortgages, this cut is a welcome relief, translating to lower monthly payments and a greater share of payments going towards the mortgage principal. Homeowners looking to buy or approaching renewal might still face higher rates compared to previous years, but these cuts bring hope for some fixed rate reductions.

On the housing front, first-time buyers could see improved affordability as mortgage rates continue to trend down coupled with recent changes in the insured mortgage rules like allowing a 30-year amortization. However, the rate cuts alone won’t drastically change the housing landscape just yet—continued cuts in the coming months will be critical to see if this momentum can sustain.

The Bank of Canada hinted at more reductions on the horizon, but it emphasized that decisions will be made on a meeting-by-meeting basis. For now, Canadians can expect some much-needed financial relief, but as always, the outlook depends on how the economy evolves.

September 4th, 2024

Prime Drops Again!

This morning, the Bank of Canada announced its third consecutive rate cut, lowering its benchmark interest rate by 25 basis points to 4.25%. Prime will now be 6.45%. This move, anticipated by many in the financial community, follows earlier cuts in June and July, signalling a shift in the Bank’s approach to combat ongoing affordability challenges. As we approach the year’s end, there’s a clear indication that rates could continue to drop

What’s Driving the Decision?

The Canadian economy is showing signs of slowing, with inflation easing to 2.5% in July. This aligns with the Bank’s goal of restoring price stability. While shelter costs continue to contribute to inflation, particularly in the housing sector, we’re seeing a gradual decline in price pressures, offering some relief to homeowners and potential buyers alike. The labour market has also slowed, with wage growth outpacing productivity, but no significant employment changes in recent months. Globally, we’re witnessing economic growth in regions like the U.S. and the Eurozone, though manufacturing has lagged, particularly in Europe. In Canada, government spending and business investments have fueled 2.1% growth in Q2, slightly surpassing forecasts.

What Does This Mean for Mortgage Holders?

For homeowners with variable-rate mortgages and Home Equity Lines of Credit (HELOCs), this rate cut offers immediate relief. As the prime lending rate decreases, you’ll likely see lower payments, easing some of the financial pressure. While fixed mortgage rates may not see an immediate shift, borrowers due for renewal over the next two years can expect a more favourable rate landscape.

Looking Forward: Is This the End of the Rate Cuts?

Many economists believe we’ll see more rate cuts heading into 2025, potentially bringing the benchmark rate down to 3%. This will come as welcome news for the mortgage market, especially as a large wave of renewals approaches.

For those in the market for a new home or facing a mortgage renewal, now is the time to explore your options.

What’s Next?

The next rate announcement is scheduled for October 23, 2024. Until then, keep an eye on the market and be prepared for more shifts. If you have questions about how these changes affect your mortgage, feel free to reach out. I’m here to help you navigate this evolving landscape.

July 24, 2024

Today the Bank of Canada cut its benchmark interest rate by 25 basis points to 4.5 per cent, it’s the second consecutive reduction, and signaled more cuts could be ahead if inflation continues to ease.

This follows a 25-basis point cut in June, which marked the first taste of interest rate relief in four years, due to cooling inflation and weaker-then-expected economic growth in the first quarter of 2024. Canada’s inflation rate fell to 2.7% in June, following an uptick in May. However, shelter price inflation is still high due to rent and mortgage interest costs, with the Bank noting this remains the biggest contributor to total inflation.

The move will come as welcome news to variable-rate mortgage holders and borrowers with home equity lines of credit (HELOCs), with rates for those product types set to dip in line with the rate cut. Prime will now be 6.7% with most lenders.

Having held that trendsetting interest rate at its highest level for more than two decades between July of last year and this June, the Bank has entered a cutting cycle in an effort to engineer a so-called “soft landing”, bringing inflation to its target without crashing the economy. Macklem reiterated several times during a press conference on Wednesday that “it is reasonable to expect further cuts going forward,” but that the bank is “not on a predetermined path.”

The bottom line is that we are continuing down the path of rate reductions which should spell some relief for all borrowers. We should see some reductions in the fixed rates as well as the bond market reacts to the announcement.

June 5th, 2024

Prime drops for the first time in 4 years!

Homeowners in Canada can breathe a sigh of relief after the Central Bank cut interest rates for the first time in four years and signalled more to come, easing some pressure on variable rate mortgage holders. The Bank of Canada has cut its benchmark interest rate by 25 basis points, a decision that marks the first time its key rate has fallen since the beginning of the COVID-19 pandemic.

This is the first sign of interest rate relief in four years for financially stretched Canadians, due to cooling inflation and weaker-then-expected economic growth in the first quarter of 2024. April inflation fell to 2.7 per cent, down from 2.9 per cent in March.

“With continued evidence that underlying inflation is easing, Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points. Recent data has increased our confidence that inflation will continue to move towards the 2% target,” the Bank noted in its interest rate announcement.

This is good news for Canadians who are renewing their mortgages, have a variable-rate mortgage, line of credit or are carrying other types of loans. However, housing experts warn that the rate cut could spark a flurry of activity in the housing market, with those who have been sidelined by higher rates seeing this as an opportunity to re-engage in the market. And a boost in demand is often accompanied by a boost in price. With the potential for further interest rate cuts this year, time will tell how the Canadian housing market responds. For now, enjoy the quarter-point cut!

April 10th, 2024

The Bank of Canada kept the lending rate untouched at five per cent, but left the door open for cuts in June, saying it believes inflation will continue to slow.

Governor Tiff Macklem said in a news conference today that a June cut is “within the realm of possibilities,” adding that central bankers have been encouraged by the progress of several main economic indicators since January.

He continued with "What do we need to see to be convinced it's time to cut? The short answer is we are seeing what we need to see, but we need to see it for longer to be confident that progress towards price stability will be sustained."

Few had expected the Bank to announce a rate cut as early as today, although expectations are hardening around a likely rate drop in the summer – possibly in June, when its next decision on rates is due but it is looking more like July at this stage.

The bottom line is we are headed in the right direction and the Central Bank just needs to see a bit more time with the improvements. Experts are predicting a 40% chance of a reduction in June and a 60% chance in July. The bond market will respond to these drops when they happen and we will see the fixed interest rates come down once we see the Prime rate start to fall

March 6th, 2024

The Bank of Canada did as most experts expected this morning and held the overnight rate steady at 5% for the fifth consecutive month, citing weak GDP, reduced consumer spending and falling wage growth as among the main drivers of its decision.

It appears to be working, with the inflation rate easing back to 2.9 per cent in January, however underlying price pressures persist. “We’ve come a long way in our fight against high inflation. . .but it’s too early to loosen the restrictive policy that has gotten us this far,” said Bank of Canada Governor Tiff Macklem, at the press conference opening statement.

The experts are still predicting the first drop in June with potentially a drop of 1% by end of 2024. The arrival of spring has brought a flurry of activity in the housing market, with both sellers and buyers eager to make their moves. There seems to be a lot of pent-up demand that is coupled with current low inventory which has me seeing most deals being multiple offers at the moment.

Fixed rates have seen a dip from their previous highs, sparking optimism among homeowners and prospective buyers alike. This drop in fixed rates has added an extra layer of excitement to the already bustling market. The bottom line is it looks like we are past the rate increases and we will hopefully see some nice interest rate reductions in 2024.

January 24th, 2024

The Bank of Canada holds Rates steady.

As most experts had predicted, the Bank of Canada announced, in a more upbeat statement, that it will maintain the overnight rate at 5%, for the fourth consecutive meeting.

There is a good chance that monetary tightening has done its job, and inflation will trend downward in the coming months. It has been a rough ride trying to get to 2% inflation, but many experts predict we are heading there probably sooner than the Bank expects. The Bank anticipates inflation to hover around 3% in the first half of 2024, gradually returning to its 2% target in 2025.

Anticipating a combination of falling inflation, weak economic growth, and a softening labour market, projections suggest that rate cuts are imminent to stimulate the economy in preparation for 2025. Analysts foresee a potential reduction in the overnight rate by June 2024. Once the Bank begins to take the rate down, it is expected that it will do so gradually, a quarter point at a time, and over a series of meetings. We could well see the overnight lending rate fall by 1% to 1.5% by the end of this year.

We have seen the Bond market starting to come down in anticipation of the reductions in the overnight Lending rate this year. This has brought the 5 year Fixed rates down from the 6.5% range into the lower to mid 5% range. Fixed rates should continue to fall as the overnight Lending rate is eased going forward this year. Prime rate remains unchanged.

We are coming out of a very tough few years for many individuals.

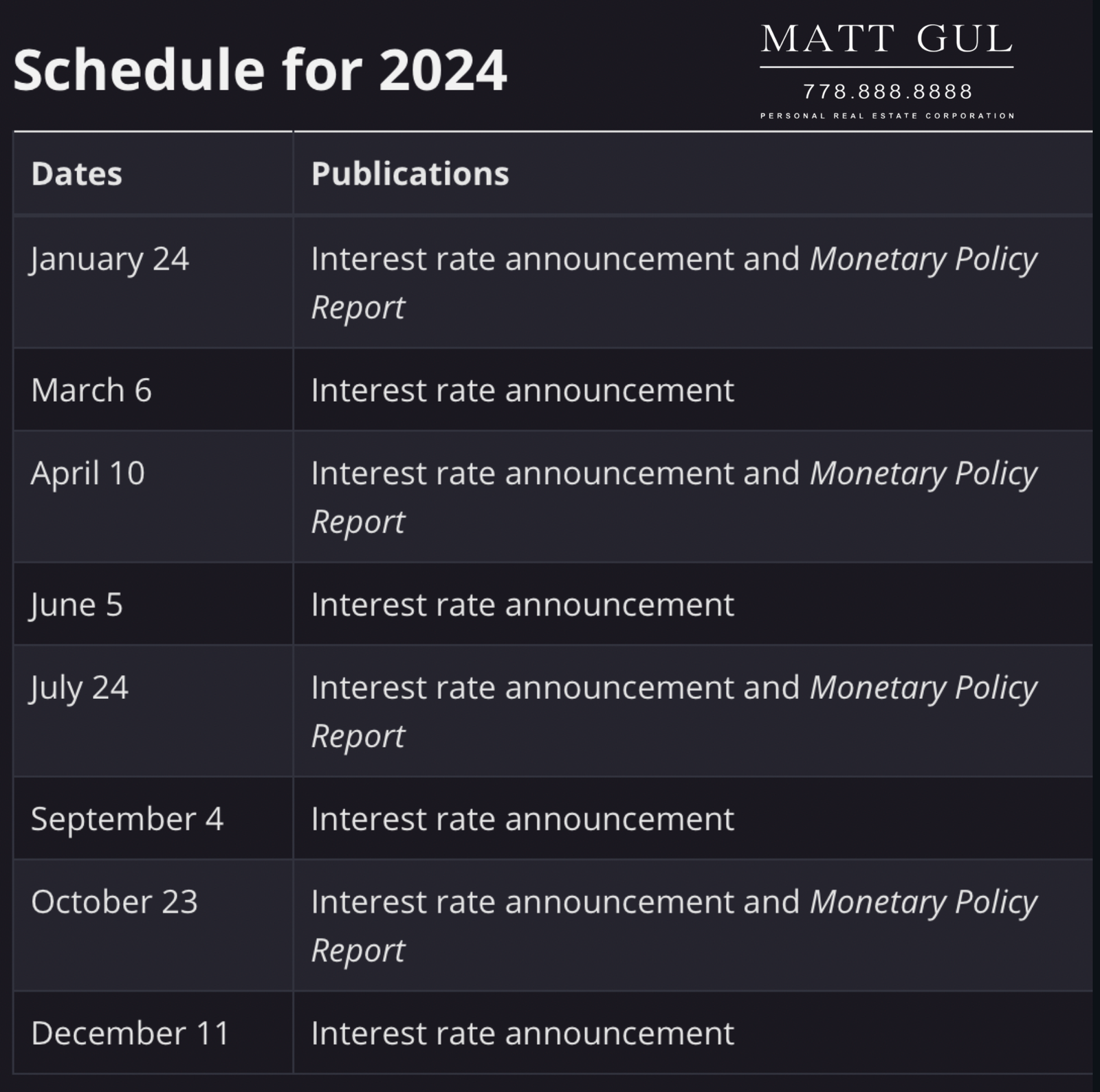

Bank of Canada Interest Rate Announcement Dates / 加拿大央行利率公佈日期

- Wed January 24 + 0.00

- Wed, March 6 + 0.00

- Wed, April 10 + 0.00

- Wed June 5 - 0.25

- Wed, July 24 - 0.25

- Wed, September 4 - 0.25

- Wed, October 23 -0.50

- Wed December 11 -0.50

If you are interested in selling or purchasing a property, please contact Matt Gul, one of West Vancouver's top Realtors at 778-888-8888, for Mortgage Advice, please contact Dave Bruynesteyn at 604-315-3283 and mention that you've been referred by Matt Gul.