***For 2024 Bank of Canada Interest Rate Announcement Dates, Please Click Here***

Wed, Dec 6

Today the Bank of Canada gave us all the gift of rate stability to end 2023.

The Bank of Canada has left its policy interest rate unchanged in its last scheduled decision of 2023, keeping rates where they are for a third consecutive announcement amidst evidence that previous hikes are proving effective in cooling the economy.

The Bank introduced 10 rate increases between March 2022 and July 2023, spiking that policy rate by 475 basis points to a 22-year high in a bid to bring spiralling inflation under control.

Canada’s annual inflation rate hit its highest level for 39 years in June 2022, but has fallen to 3.1% with signs that core price pressures are beginning to ease.

The recent economic slowdown and series of rate pauses by the central bank have sparked some speculation about when interest rates are likely to start falling.

Economists generally believe the Bank will start cutting rates at some point in 2024, although an exact timeframe remains unclear.

Wed, Oct 25

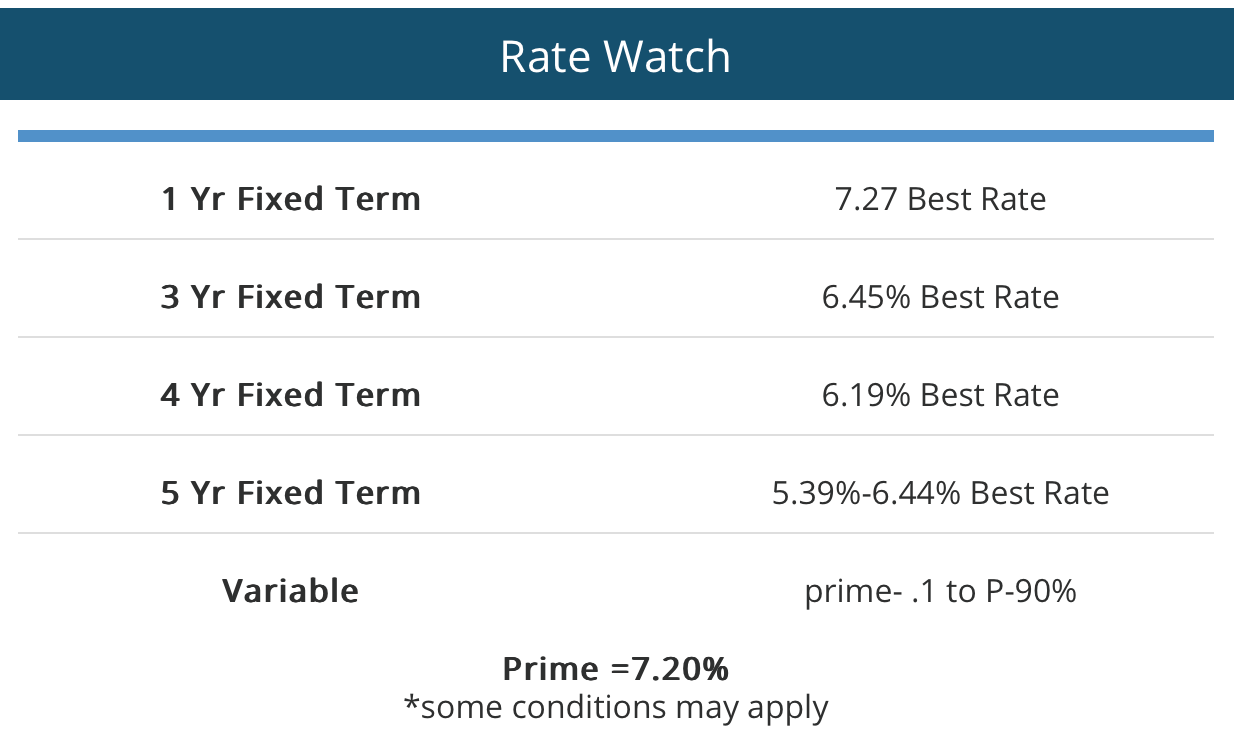

The Bank of Canada announced today that it is holding the line on interest rates. After 10 increases since March of 2022, the overnight rate stays at 5.0% for now. This means Prime stays steady at 7.20%.

Overall inflation slowed more dramatically in September than markets had expected, to 3.8%, while gross domestic product (GDP) growth also moderated noticeably towards the end of summer. This decision provides some comfort to borrowers who have seen their mortgage costs rise steadily since March of 2022.

As for real relief – in the form of rate cuts – the Bank demurred, noting that its preferred measures of core inflation show “little downward momentum.” Consequently, the Bank said it is holding this policy rate and continuing its current policy of quantitative tightening.

In the Bank’s October projection, CPI inflation is expected to average about 3.5% through the middle of next year before gradually easing to 2% in 2025. Inflation is expected to return to the Bank’s target about the same time as policymakers forecast in their July 2023 projection, “but the near-term path is higher because of energy prices and ongoing persistence in core inflation.”

The message is therefore clear: the Bank wants to see downward movement in core inflation before it considers reductions in the rates.

We will hopefully see the rates stay steady until mid 2024 when inflation is forecast to be in control and we will finally see some reductions in the Prime rate.

The next Bank of Canada rate review is December 6th.

Wed, Sep 6

Today the Bank of Canada was persuaded to hold its key interest rate steady as signs of a faltering economy emerge, but with inflation still above target, the central bank is walking a tight line to avoid fueling speculation of rate cuts.

This means that the prime interest rate did not move.

“With recent evidence that excess demand in the economy is easing, and given the lagging effects of monetary policy, governing council decided to hold the policy interest rate at five per cent,” the central bank said in a news release on Wednesday.

However, the Bank of Canada is keeping the door open to more rate hikes, with a hawkish tone as it notes its governing council is still concerned about inflationary pressures and “is ready to raise interest rates further if needed.”

Canada’s inflation rate was 3.3 per cent in July, ticking up from 2.8 per cent in the previous month.

Although inflation has slowed considerably since last summer, it's expected to hover around three per cent for months to come. The central bank acknowledges that inflation will even likely flare up due to higher gasoline prices before coming back down.

The Bank of Canada remains unwavering in its commitment to restoring price stability and is prepared to raise rates further, if necessary, due to concerns about underlying inflationary pressures.

The next Bank of Canada rate review is October 25th

Wed, July 12

This morning the Bank of Canada has hiked its Policy interest rate by 25 basis points, bringing the rate to its highest level since April 2001 as the Central Bank continues its lengthy fight against inflation.

This increases prime to 7.20%. Governor Tiff Macklem suggested residual pandemic savings have delayed the impact of efforts to rein in inflation.

Today’s rate hike came despite some easing in inflation including lower energy prices. “Inflation in Canada eased to 3.4 per cent in May, a substantial and welcome drop from its peak of 8.1 per cent last summer,” Macklem said. However, he noted that the majority of goods in the consumer price index “basket” have continued to rise, some steeply.

Despite these increases, Canada’s economy has been stronger than expected with demand momentum and consumption growth “surprisingly strong at 5.8 per cent,” the bank said in commentary explaining the latest rate decision.

Macklem said that while many households have cut back on spending because of higher inflation and interest rates, others accumulated savings since the beginning of the COVID-19 pandemic that “may be acting as a buffer and supporting consumer spending.”

Another surprise was the housing market defying expectations by showing signs of picking up after a slowdown earlier this year. Moreover, the job market remains tight, with wage growth of between four and five per cent.

Macklem said the central bank is trying to strike a balance of doing enough but not too much with its monetary policy, and acknowledged that past rates hikes are still working their way through the system.

He said the bank’s governing council considered leaving rates unchanged this month to ease the burden of higher rates, but concluded that there was less risk in doing something now than waiting and having to take more aggressive action later.

With the latest hike, the Bank of Canada projects that inflation will stay around three per cent for the next year, returning to the two per cent target by the middle of 2025. That is about six months later than the forecast the central bank made in April

Wed, June 7

Today, the Bank of Canada increased its overnight interest rate to 4.75% (+0.25% from April) because of higher-than-expected growth in Canada’s economy in the first quarter and the view that the monetary policy was not yet restrictive enough to bring inflation down to target.

While global consumer price inflation is showing a downward trend due to lower energy prices, underlying inflation remains stubbornly high.

Leading up to today’s announcement, many economists feared that the Bank of Canada would have no choice but to raise rates in the face of persistent inflation and recent GDP growth. Their fears were founded.

To understand the Bank’s thinking on this important topic, its latest observations are below:

- In Canada, Consumer Price Index (CPI) inflation “ticked up in April” to 4.4%, the first increase in 10 months, with prices for a broad range of goods and services coming in higher than expected

- Goods price inflation increased, despite lower energy costs

- Services price inflation remained elevated, reflecting strong demand and a tight labour market

- The Bank continues to expect Consumer Price Index inflation to ease to around 3% in the summer, as lower energy prices “feed through” and last year’s large price gains “fall out” of the yearly data

Wed, April 12

As expected, The Bank of Canada left its overnight lending interest rate at 4.5%, leaving that key rate untouched for a second consecutive month as it continues a careful pivot away from its rate-hiking trajectory of the past year.

Below is an analysis by Matt Gul's friend, Dave Bruynesteyn - the North Shore's Mortgage Expert.

"The hold, which was widely expected by economists, comes after eight consecutive increases saw the key rate rise by 4.25% since March of last year. The central bank undertook one of the fastest rate tightening cycles in its history in hopes of tamping down rampant inflation.

Canada’s annual inflation rate has cooled from highs of 8.1% in mid-2022 to 5.2% as of February. Shorter-term measures of core inflation — a metric the Bank follows closely as it strips out more volatile price pressures — are also heading in the right direction as of late.

The Bank of Canada said in a statement accompanying the rate decision on Wednesday that the latest economic data is in line with its forecast calling for inflation to return to around three per cent by mid-2023 and then decline more gradually to the 2% target by the end of 2024"

Wed, March 8

The Bank of Canada held its policy interest rate steady for the first time in a year. As a result, the benchmark interest rate remains at 4.50% and Prime at 6.70%.

Below is an analysis by Matt Gul's friend, Dave Bruynesteyn - the North Shore's Mortgage Expert.

"The Bank holding rates steady was a great relief to all the variable interest rate clients out there who have seen eight straight interest rate increases since the beginning of 2022. The Bank is also continuing its policy of quantitative tightening. Canada is the first bank to pause raising interest rates among the worlds major central banks."

"The fourth quarter of last year saw economic growth slow to a halt. The increase in interest rates slowed housing activity significantly. "Inflation eased to 5.9% in January, reflecting lower price increases for energy, durable goods and some services. Price increases for food and shelter remain high, causing continued hardship for Canadians.”

"The Bank of Canada will continue to monitor the economy going forward to maintain its goal of 2% inflation. Most economists think the Bank of Canada will hold the overnight lending rate at 4.5% for the rest of the year. Fixed rates continue to be around 5% for 5 year term these days and we need some more stability in the world before I expect we will see any major reductions"

Wed January 25

At the end of January 2023, The Bank of Canada announced what it expects to be its last interest rate hike of the current cycle as it pauses to assess the effects of higher rates on the economy.

Below is an analysis by Matt Gul's friend, Dave Bruynesteyn - the North Shore's Mortgage Expert.

"The .25% rate hike comes after months of inflation slowing in Canada. After peaking at 8.1% in the summer, the country's annual inflation rate has steadily declined and reached 6.3% in December. The Bank of Canada also published its latest monetary policy report which provides updated projections for the economy and inflation.

According to the report, the central bank expects inflation to slow faster than it had previously anticipated. It’s forecasting the annual inflation rate will fall to three per cent by mid-2023 and to its two per cent target in 2024. “We’ve raised rates rapidly, and now it’s time to pause and assess whether monetary policy is sufficiently restrictive to bring inflation back to its two per cent target,” Bank of Canada Governor Tiff Macklem told reporters after the announcement on Wednesday.

What does this mean to you? If you have been riding the variable rate wave, we look to be at the peak and we can expect to see some reductions in the rate towards the end of the year if inflation continues to fall. If you are in a fixed rate term this won’t have any effect on your current mortgage. As far as fixed rates go, the bond market is still looking at a lot of uncertainty in the world. It is expected that fixed rates will stay around the current levels for the time being.

Bank of Canada Interest Rate Announcement Dates / 加拿大央行利率公佈日期

- Wed January 25 +0.25%

- Wed, March 8 +0.00%

- Wed, April 12 +0.00%

- Wed June 7 +0.25%

- Wed, July 12 +0.25%

- Wed, September 6 +0.00%

- Wed, October 25 +0.00%

- Wed December 6 +0.00%

- Wed, March 8 +0.00%

- Wed, April 12 +0.00%

- Wed June 7 +0.25%

- Wed, July 12 +0.25%

- Wed, September 6 +0.00%

- Wed, October 25 +0.00%

- Wed December 6 +0.00%

If you are interested in selling or purchasing a property, please contact Matt Gul, one of West Vancouver's top Realtors at 778-888-8888, for Mortgage Advice, please contact Dave Bruynesteyn at 604-315-3283 and mention that you've been referred by Matt Gul.