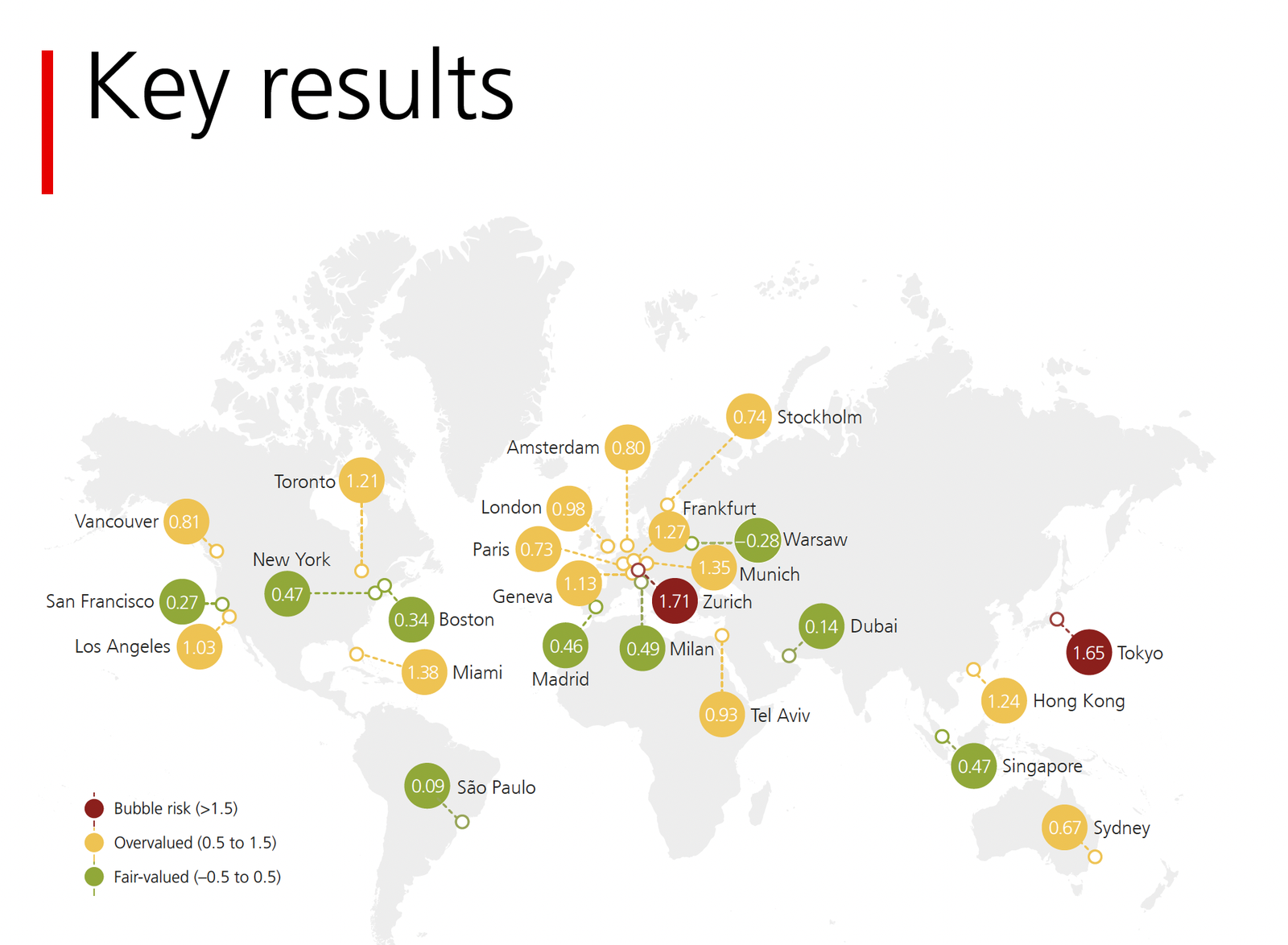

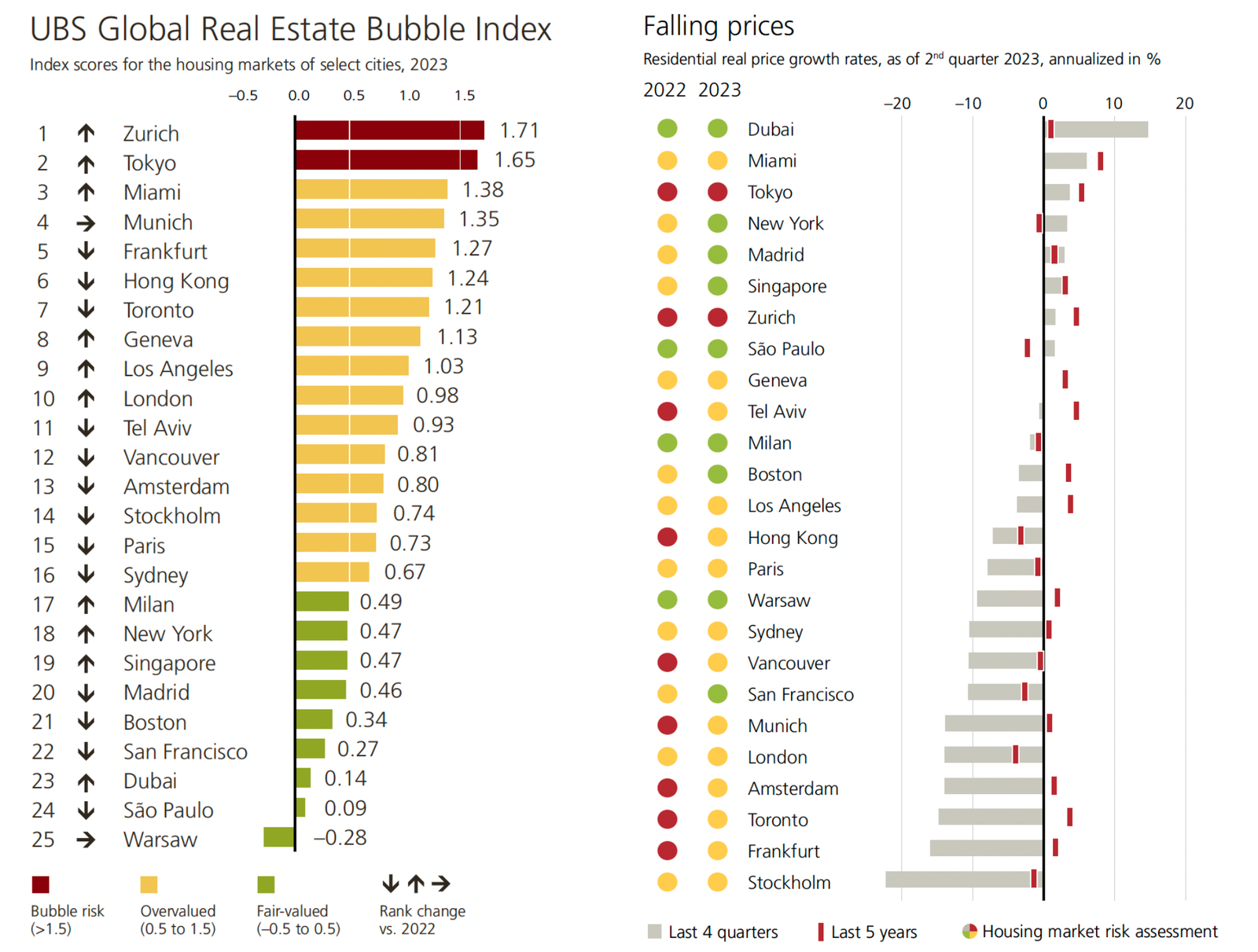

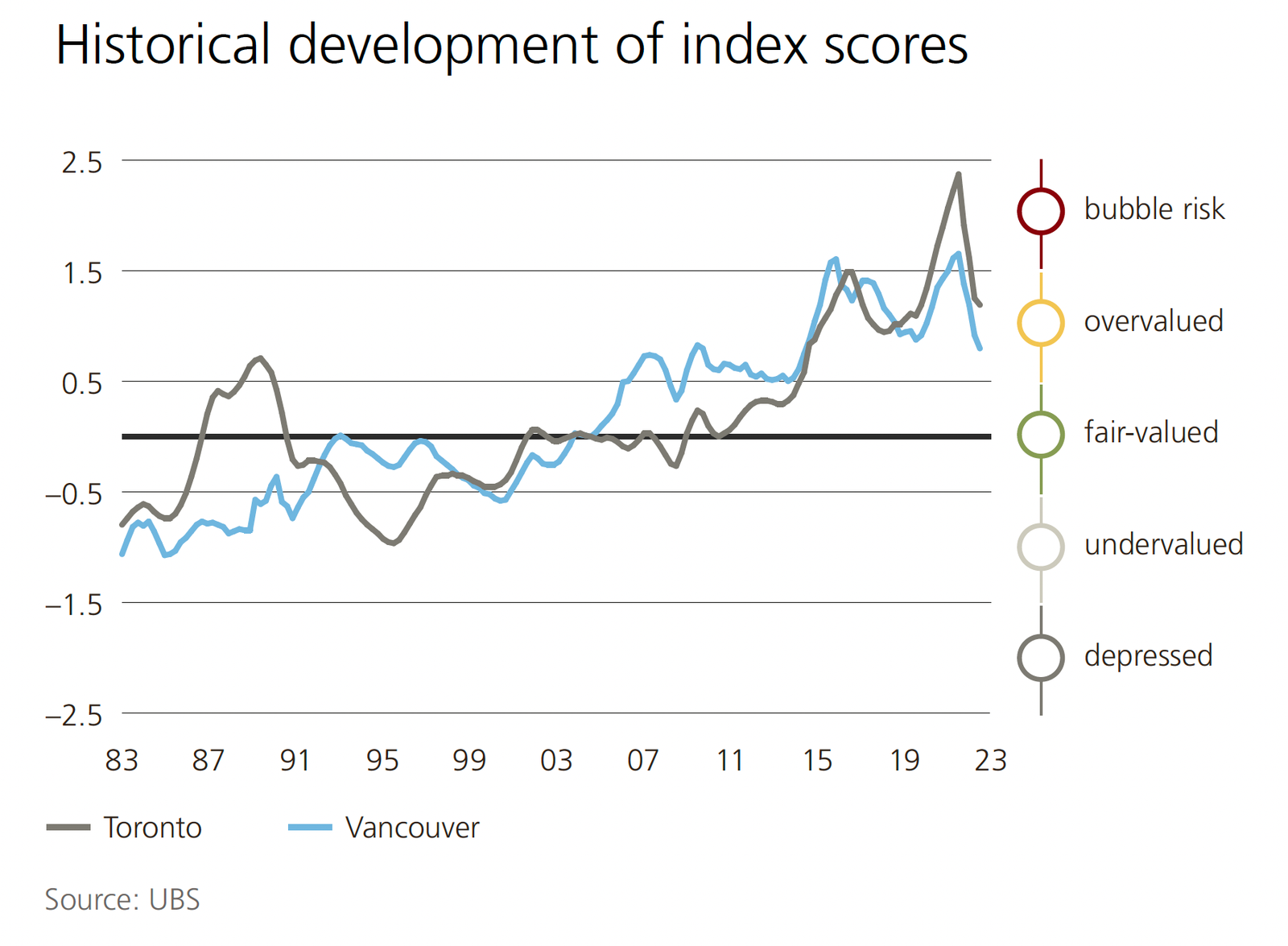

*Vancouver and Toronto are no longer in the bubble risk territory, as opposed to in 2022 & 2021*

Key Results

Prices in Reverse Gear

Most analyzed urban centers haveseen a real house price drop duringthe last four quarters. In cities at bubble risk during the last three years, property prices have declined by 10% on average.

Fewer Cities at Bubble Risk

Risk scores have dropped sharply in most cities in recent quarters. High imbalances persist in Zurich and Tokyo—relatively low mortgage and inflation rates have not caused any market disturbance there.

Tight Financing Conditions

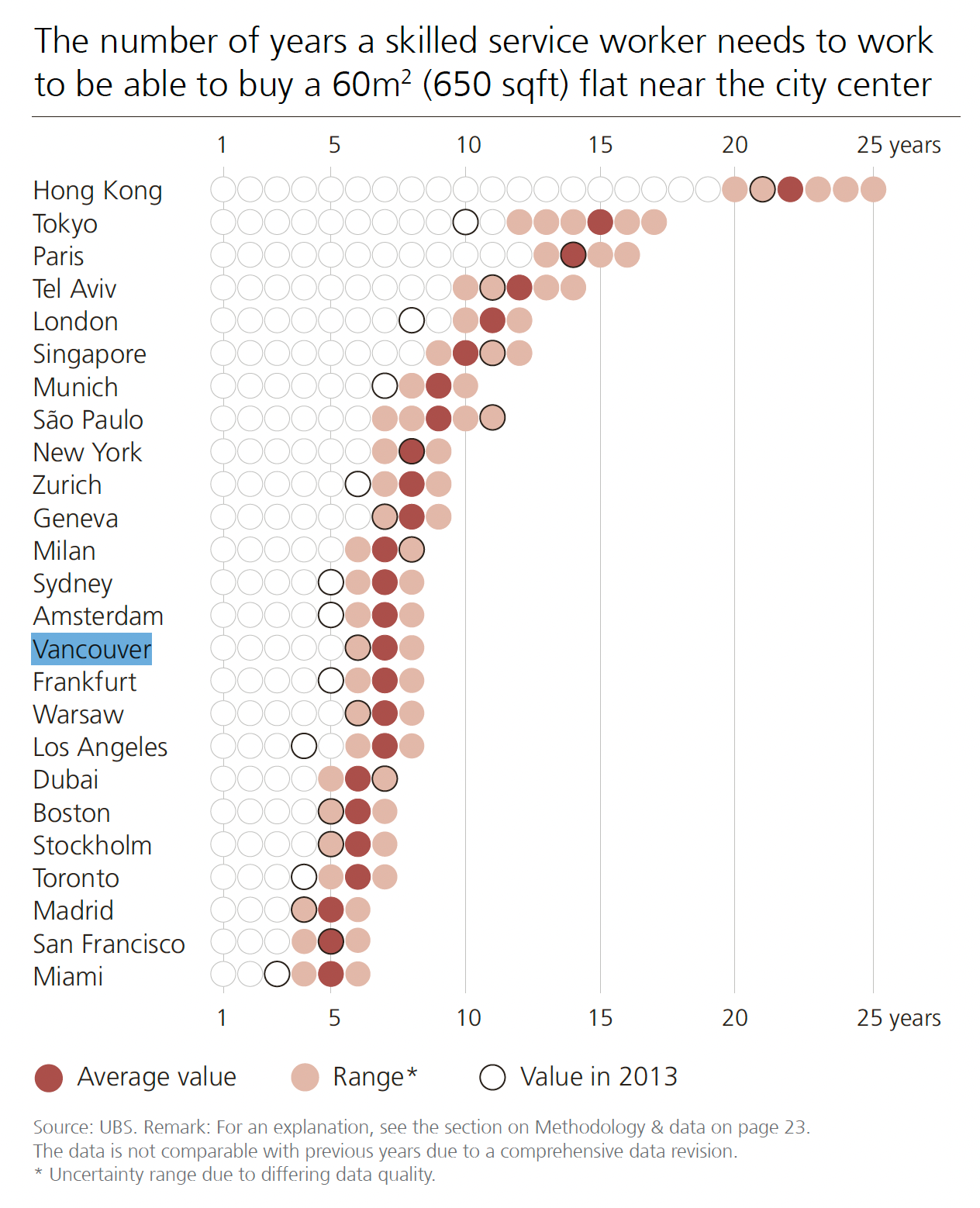

Financial affordability of housing has collapsed as mortgage rates have roughly tripled since 2021 in most markets. Therefore, household leverage has been declining in most countries in recent quarters.

Inflation as Game-Changer

Inflation made a decisive contribution to the reduction in imbalances. While rising interest rates put pressure on house prices, inflation supports income and rental growth. The latter has accelerated in most cities outside the US and reached the highest value in almost a decade.

Too Early for Turnaround

There is more downside in real house prices. However, a housing shortage has set the stage for a renewed boom

in many cities—if interest rates fall.

Defying Gravity

The most sought-after destinations in recent years are Singapore, Dubai, and Miami. In those hotspots of international demand, rental and for-sale price growth clearly stand out. Prices are up as much as 40% and rents 50% higher than two years ago.

The global surge in inflation and interest rates over the past two years has led to a sharp decline in imbalances in the housing markets of global financial centers on average, as measured by the UBS Global Real Estate Bubble Index. In this year’s edition, only the two cities Zurich and Tokyo have remained in the bubble risk category, down from nine cities a year ago. Formerly in the bubble risk zone, Toronto, Frankfurt, Munich, Hong Kong, Vancouver, Amsterdam, and Tel Aviv saw their imbalances decline and are now in the overvalued territory. Housing markets in Miami, Geneva, Los Angeles, London, Stockholm, Paris, and Sydney are overvalued as well.

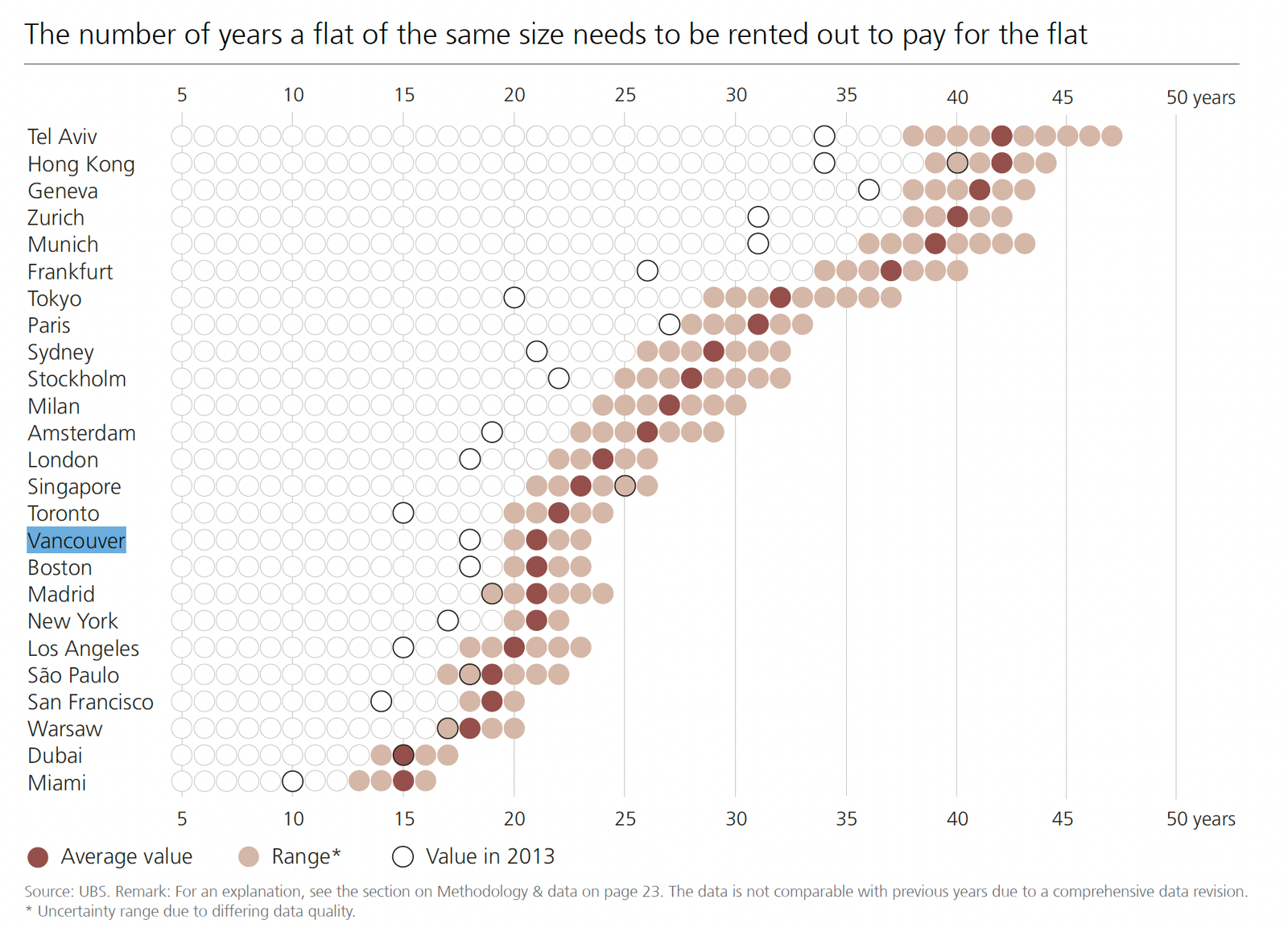

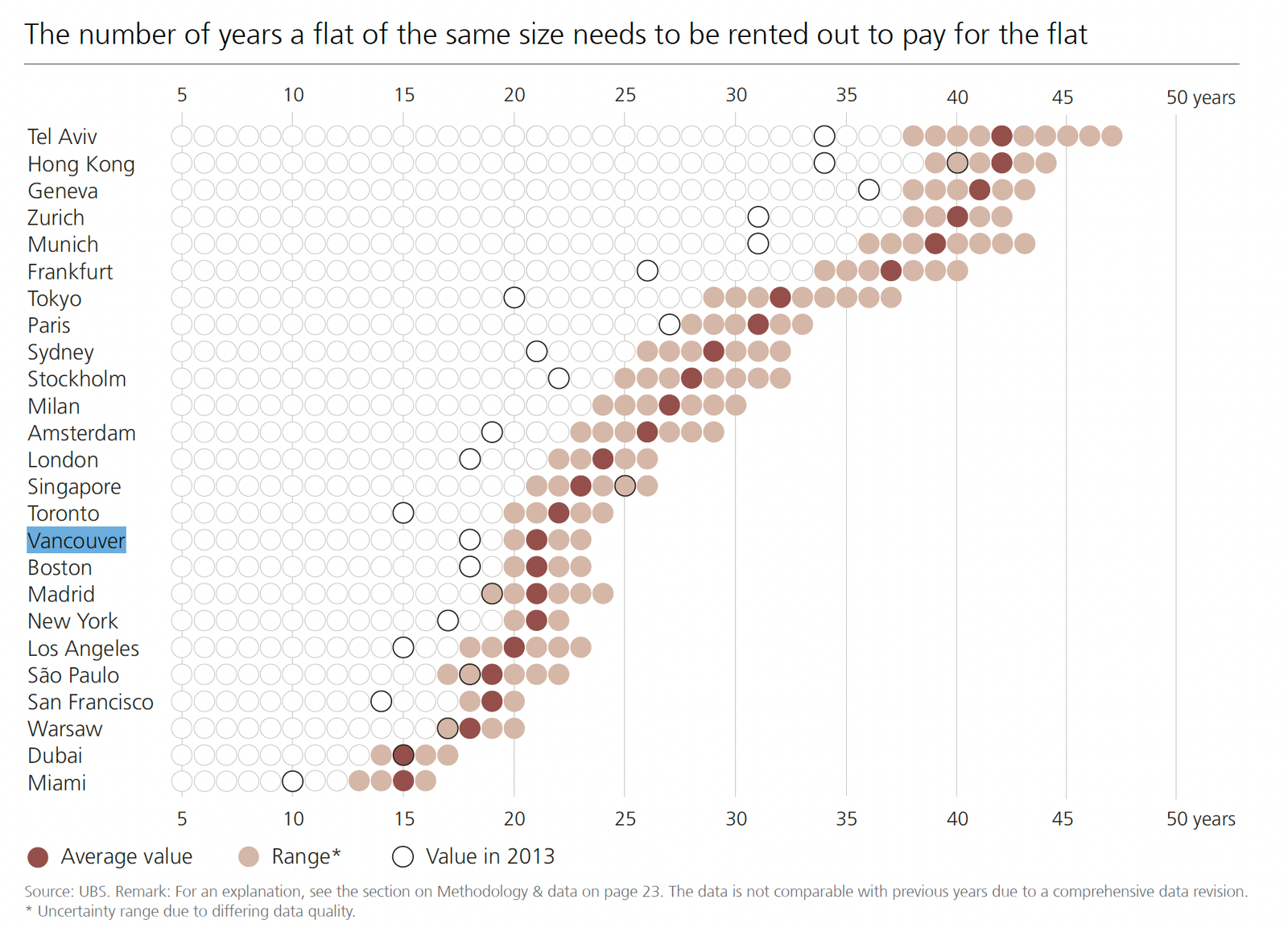

Higher interest rates have impacted house prices differently depending on existing market imbalances and prevailing mortgage terms. In Frankfurt and Toronto —the two cities with the highest risk scores in last year’s edition—real price tumbled by 15% in the last four quarters. A combination of high market valuations and relatively short mortgage terms put prices also under strong pressure in Stockholm and to a lesser degree in Sydney, London, and Vancouver. In contrast, in Madrid, New York, and São Paulo —cities with moderate risk valuations so far—real home prices have continued to rise at a subdued pace.

Regional Focus: Canada

As demand for living space in these cities is rising steadily, the pressure is shifting to the rental market. In Vancouver, real rents have climbed around 10% compared to a year ago, while they are a good 5% higher in Toronto. Both cities were showing signs of housing market recovery in the spring with increasing numbers of transactions and positive price growth. Nevertheless, it is premature to speak of a turnaround against the backdrop of recent interest rate hikes from the Bank of Canada.

City Benchmarks