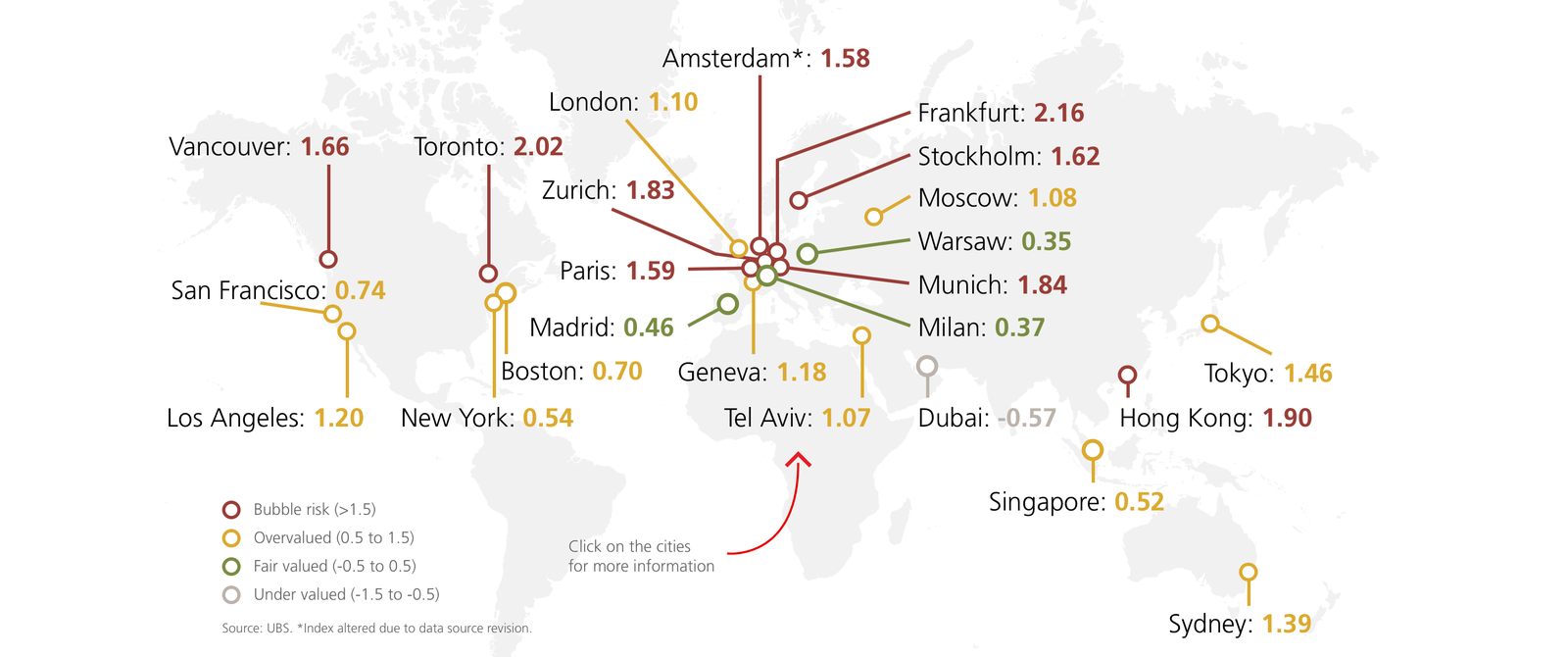

Vancouver

The introduction of vacancy fees and a foreign buyers’ tax in 2016 curbed foreign demand and triggered a price correction in the red-hot housing market of Vancouver. Between 2018 and 2019, real price levels declined by almost 10%. Since then, however, lower prices, falling mortgage rates, and looser stress test rules have enticed households to buy properties again, leading to a fast rebound. From mid-2020 to mid-2021, property prices increased by 11%, offsetting past losses. In an effort to temper housing demand and boost market resilience, the mortgage qualifying rate was recently lifted again. While the ongoing economic rebound will likely support demand in the coming months, affordability has once again returned to the spotlight. Tightening down payment and income requirements for mortgages should moderate current market dynamics.

"Over the last ten years, in Toronto the real price level has almost doubled amid strong population growth and falling mortgage rates. After the introduction of restrictive regulations (e.g., a foreign-buyers’ tax and rent controls), the market took a breather in 2017 and 2018, only to reaccelerate in 2020. Real prices increased by almost 8% over the last four quarters."

Source: https://www.ubs.com/global/en/wealth-management/insights/2021/global-real-estate-bubble-index.html