Metro Vancouver’s housing market is closing out 2025 firmly in buyers’ territory, as slower sales, high inventory, and uncertain interest rate forecasts shape the landscape. Meanwhile, new national data underscores just how vital real estate transactions remain to Canada’s broader economy.

Metro Vancouver Market: Buyers Regain the Upper Hand

Home sales across Metro Vancouver fell again in October, marking a 14 per cent year-over-year drop as listings continued to accumulate. The Greater Vancouver REALTORS® (GVR) reported 2,255 residential sales in October 2025, down from 2,632 in October 2024, 14.5 per cent below the 10-year seasonal average.On the supply side, 5,438 new listings hit the market last month, virtually unchanged from last year but 16.3 per cent above the 10-year seasonal average.Overall inventory climbed to 16,393 active listings, up 13.2 per cent year-over-year and 35.9 per cent above the long-term average, giving buyers more options and leverage than at any point in recent years.The sales-to-active listings ratio across all property types stood at 14.2 per cent, with detached homes at 11.3 per cent, attached homes at 17.6 per cent, and apartments at 15.5 per cent. Historically, prices tend to fall when the ratio dips below 12 per cent for several months.“After peaking in June, inventory levels have edged lower, and prices have eased across all market segments as slower-than-usual sales activity meets the highest inventory levels seen in many years,” said GVR President Lis. “With no further reductions to the Bank of Canada’s policy rate expected in 2025, market conditions appear as favourable for buyers as they’ve been all year.”

Prices Ease Across All Segments

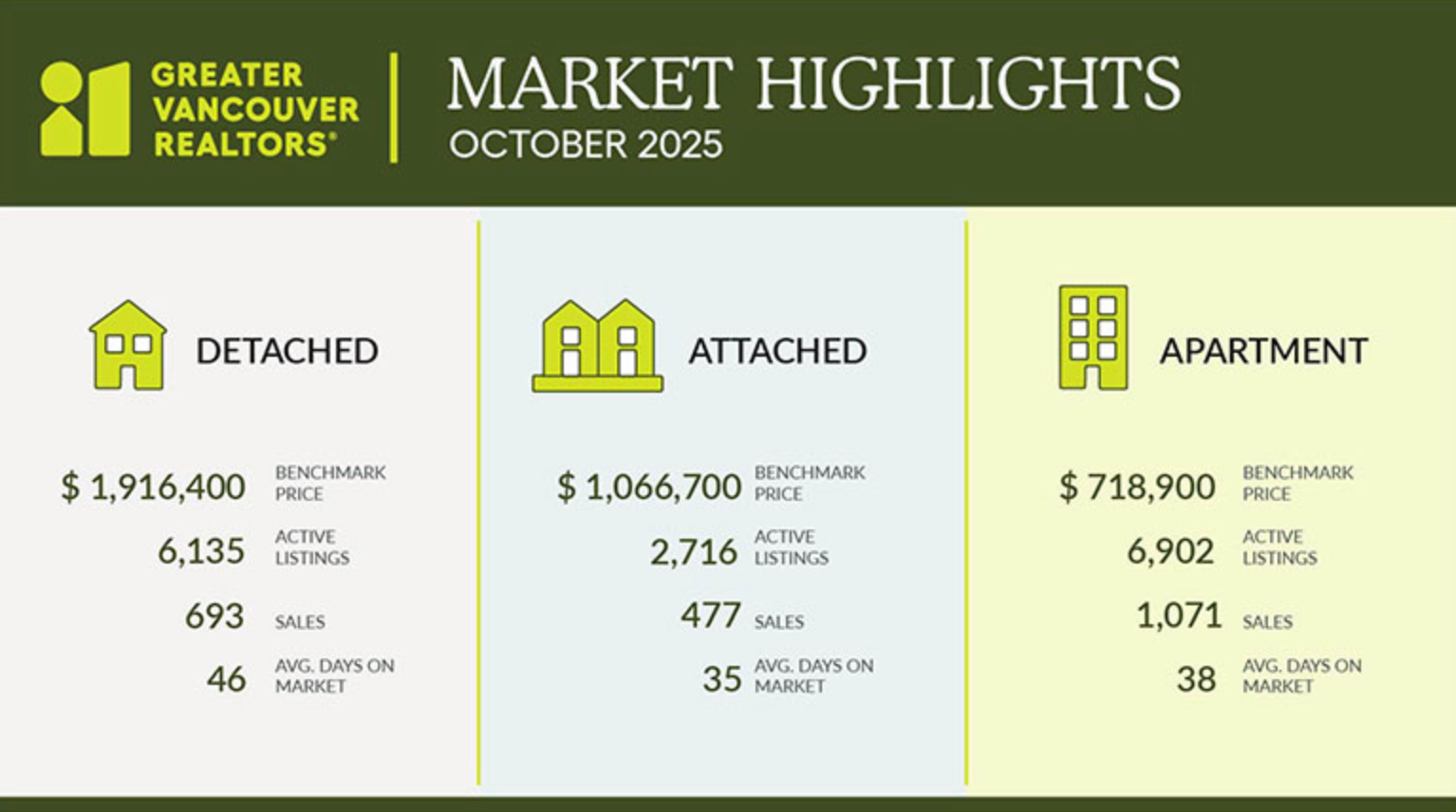

The MLS® Home Price Index (HPI) composite benchmark price for all residential properties in Metro Vancouver is $1,132,500, a 3.4 per cent decline from October 2024 and 0.8 per cent lower than September 2025.- Detached homes: Benchmark price $1,916,400 (↓ 4.3% year-over-year)

- Attatched: Benchmark price $1,066,700 (↓ 3.8% year-over-year)

- Apartments: Benchmark price $718,900 (↓ 5.1% year-over-year)

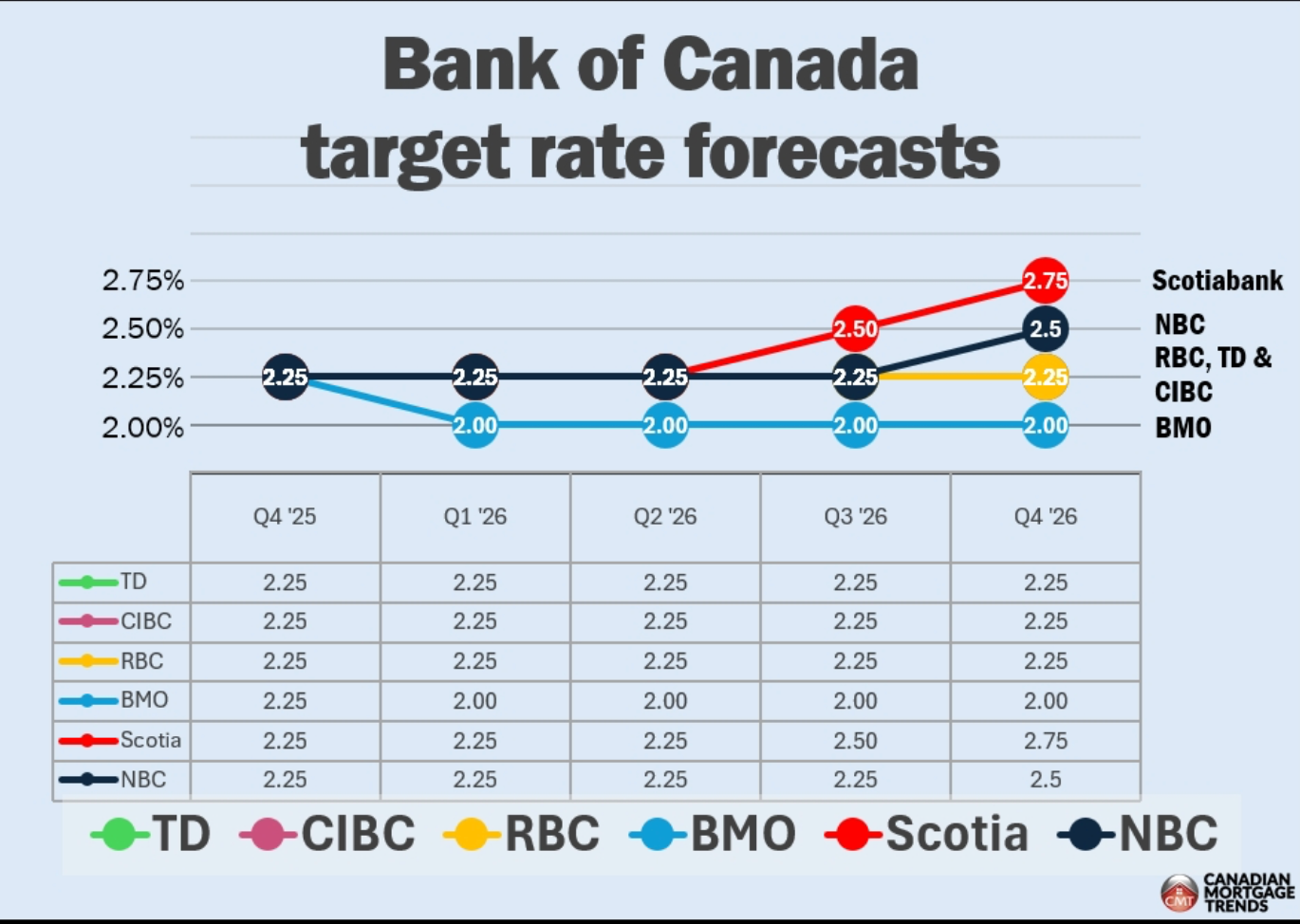

Interest Rate Outlook: Banks Split on 2026 Forecasts

The Bank of Canada’s benchmark rate sits at 2.50%, down from last year’s 5% peak, but economists remain divided on what comes next.- RBC expects the rate to hold near 2.25% through 2026, taking a more dovish stance.

- BMO projects a further drop to 2.00% by early 2026.

- Scotiabank sees a rebound to 2.75% by late 2026.

- National Bank forecasts 2.50%, while TD and CIBC anticipate 2.25%.

The Broader Picture: Real Estate’s Ongoing Economic Impact

Despite market cooling, Canada’s real estate sector remains a major economic driver. A new 2025 Altus Group report for the Canadian Real Estate Association (CREA) estimates that resale transactions through MLS® Systems generate $46.8 billion annually in economic activity — up from $41 billion in the previous study.Each transaction triggers roughly $97,500 in spin-off spending, from renovations and furniture purchases to legal, appraisal, and real estate services. On average, a single home sale stimulates nearly $30,000 in renovation spending alone.The study found that housing-related activity supports 231,500 jobs annually and produces over $19.3 billion in tax revenues for all levels of government. Even with a 4 per cent decline in national resale volumes early in 2025, these impacts will continue to ripple through the economy into next year.As Altus notes, “The market remains a key pillar of economic health — driving jobs, investment, and growth across communities nationwide.”

Takeaway: A Transitional Moment for Canada’s Housing Market

As 2025 draws to a close, Canada’s real estate landscape sits at an inflection point.In Metro Vancouver, slowing sales and elevated listings have tipped the balance toward buyers. Nationally, uncertainty around interest rate direction and inflation keeps both investors and homeowners cautious — yet the housing market continues to underpin the country’s economic stability.For motivated buyers, the combination of softening prices, ample inventory, and steady borrowing costs may mark the most balanced conditions seen in years.