Buyers Show Optimism and Sellers Adjust Their Expectations as Market Conditions Shift

After a first quarter marked by consumer uncertainty and a noticeable retreat of buyers, the Canadian housing market appears poised for a potential rebound this fall. Easing affordability pressures and a rise in inventory could help draw cautious buyers back into the market.

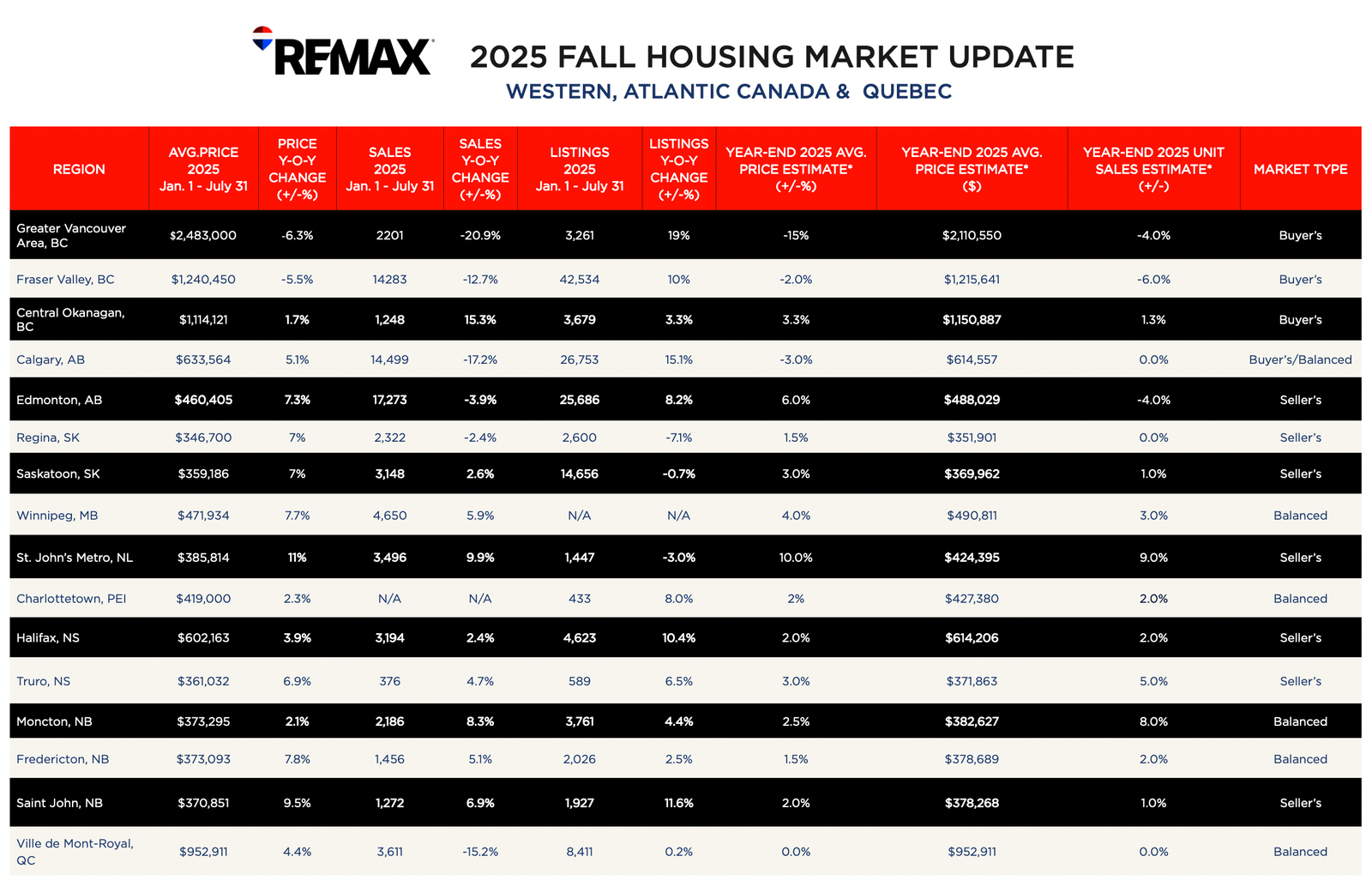

Data from RE/MAX brokers and agents shows that between January 1 and July 31, 2025, home sales declined year-over-year in 62 per cent of the markets analyzed—largely reflecting the economic unease felt nationwide. Price performance, however, varied by region: values climbed across Atlantic Canada and the Prairies, while major urban centres in Ontario and British Columbia posted declines.

In a shift from the tight supply that defined many markets in 2024, listings have increased in Ontario and British Columbia this year, pushing conditions toward a buyer’s market. By contrast, inventory remains lean across the Prairies and Atlantic Canada, where sellers continue to hold the advantage.

“Canada’s real estate landscape paints a complex picture of resilience and caution, influenced by regional nuances and continued economic uncertainty. From seller-driven markets across much of Atlantic Canada and the Prairies, to buyer-friendly conditions in Ontario and BC, the nation’s housing market reflects a delicate balance,” says Don Kottick, President of REMAX Canada. “What hasn’t changed is that Canadians see value in home ownership, and an experienced, professional real estate agent can help buyers and sellers tailor their strategies to better set themselves up for success, regardless of market conditions.”

First-Time Homebuyers Shifting in Demographics and Influence

In 2024, first-time buyers drove sales in the majority of markets across Canada. In a notable shift, REMAX brokers and agents report that first-timers have taken a back seat in today’s market, with families, new Canadians and retirees driving the bulk of activity in 2025

7% of Canadians say they intend to buy their first home within the next 12 months.

This group is trending older, with many now entering the market in their late-20s to 40s, reflecting both broader affordability challenges and the increasing complexity of entering the market. The Leger survey also reveals that today's first-time homebuyers are financially varied, some entering with strong savings and others relying on more creative strategies to get their foot in the door.

28% of Canadians planning to buy their first home in the next 12 months say they have saved at least 20 per cent for their down payment.

68% of Canadians say a five- to 10-per-cent drop in property prices would make a meaningful difference in their ability to enter the market.

“These insights paint a picture of first-time buyers who are older, more financially prepared in some cases, but still navigating significant headwinds and waiting for the market to meet them halfway,” says Kottick. “The good news is inventory levels are rising in most regions, giving buyers more choice, negotiating leverage and more time to make purchasing decisions. -Don Kottick, President of REMAX Canada

Sellers Approach the Fall Market with Realism, Strategic Timing and Growing Confidence

63% of those planning to sell believe they’ll be able to secure their asking price.

A recent Leger survey highlights the diverse financial realities of today’s first-time homebuyers. While some enter the market with substantial savings, others are turning to alternative strategies to secure a foothold. Twenty-eight per cent of prospective buyers planning to purchase within the next 12 months report having saved at least 20 per cent toward a down payment, while one-third (33 per cent) have saved 15 per cent or more, and 13 per cent have saved at least 10 per cent. Only one in 10 Canadians say they have received financial gifts to assist with a home purchase, suggesting that most are relying on disciplined savings, co-ownership models, or other non-traditional pathways.

Overall, 12 per cent of Canadians indicate plans to purchase a home in the coming year, though many are waiting for the right conditions. Among this group, 68 per cent say a five- to 10-per-cent drop in property values would meaningfully improve affordability, while 64 per cent report that a reduction in interest rates of 0.5 to one percentage point would give them the confidence to buy.

As economic uncertainty persists and the Canadian housing market evolves, REMAX brokers and agents agree that sellers with a clear, well-defined strategy are best positioned for success. This includes setting realistic prices, investing in smart staging, and maintaining a strong grasp of local market dynamics.

Currently, eight per cent of Canadians plan to sell their home within the next year. Among them, confidence remains high: 63 per cent believe they will achieve their asking price, according to a Leger survey. This suggests sellers are increasingly aligning expectations with what today’s buyers are prepared to pay in a more balanced market environment.

Looking ahead, with prices projected to edge lower by the end of 2025 and pent-up demand still reverberating across many regions, conditions could prove favourable for informed, well-prepared sellers.

“Our Fall Housing Market Update reflects a dynamic shift, with brokers reporting a 25-per-cent increase in conditional sales across 33 of 37 regions surveyed, alongside growing buyer confidence driven by improved affordability,” says Kottick. “Homeownership remains a cornerstone investment for Canadians, and REMAX agents are committed to guiding buyers and sellers through this evolving landscape with expertise and support.”

“This is a pivotal period, where informed, well-timed decisions will make all the difference for Canadians navigating a shifting market,” Kottick adds.

Trends in the Vancouver Housing Market

The Vancouver housing market continues to reflect widespread uncertainty among both buyers and sellers. Buyer sentiment is marked by anxiety about the future, while many sellers remain pessimistic, anticipating prolonged challenges ahead. Inventory levels remain elevated, with days on market ranging from 74 to over 300 — nearly 20 per cent longer than last year. Sales volumes are lower than in many other regions, largely due to Vancouver’s higher price points.

A notable driver of activity in the region has been locals choosing to downsize, a trend expected to persist through the remainder of the year. Still, the market’s greatest hurdle remains economic uncertainty.

Vancouver is now grappling with a surplus of listings, as many sellers continue to price their homes based on last year’s values. In reality, prices have not only softened but continue to slide, prompting buyers to hunt for bargain opportunities and “fire-sale” deals. Consumer confidence remains weak, with many prospective buyers hesitant to enter the market amid concerns that prices could drop further after purchase. Some are adopting a wait-and-see approach, monitoring the possibility of additional interest rate cuts.

Looking ahead, the region may require renewed investment to absorb excess supply. One potential solution could be the reintroduction of foreign ownership, which could help offset the current slowdown. Recent cooling measures have significantly tempered domestic demand, leaving sales activity well below expectations.