Despite a Second Monthly Gain, National Home Sales Still Forecast to Decline

Home sales in Canada rose for the second consecutive month in June, with a 2.8% increase compared to May, driven largely by a rebound in the Greater Toronto Area—where sales have surged 17.4% since April.

However, the Canadian Real Estate Association (CREA) now expects total sales for 2025 to fall 3% below 2024 levels, signaling that the market’s recent momentum may not be enough to offset broader year-over-year declines.

“At the overall national level, June was kind of a carbon copy of May in a lot of ways,” said CREA’s Senior Economist Shaun Cathcart in the latest CREA Housing Market Report (watch below), “which is good, because it means sales were up again and prices held steady again, as opposed to falling.”

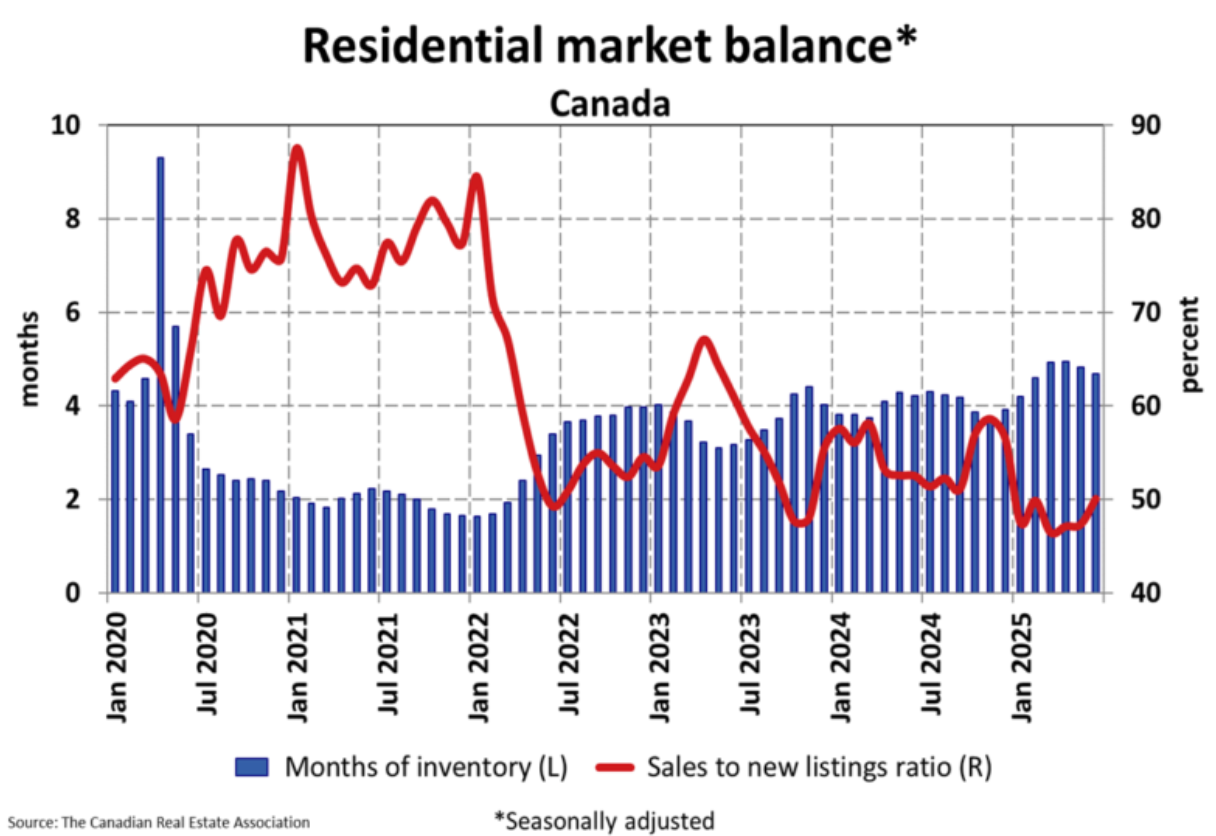

Cathcart said it’s “another month of evidence” to play into a turning of tides when it comes to Canada’s real estate landscape, which was previously seeing declines in sales and prices, while new listings were increasing. That wasn’t the case in June.

Before we get into more of the data, here’s what you need to know at a glance:

Is this a good time for buyers? Falling Rates and Rising Inventory Could Entice Homebuyers—Despite Market Uncertainty.

According to Cathcart, home prices have stabilized following their recent correction. While increased listings typically shift conditions in favor of buyers, a mix of other factors is also making homeownership more appealing.

Interest rates are on a downward trend, with the Bank of Canada’s policy rate dropping from 5% in April 2024 to 2.75% today. Although another rate cut isn’t expected this month, and experts have scaled back their forecasts to just one potential cut by year-end, borrowing costs remain significantly lower than last year. The Bank’s next rate announcement is scheduled for July 30.

On the supply side, housing inventory is up 11.4% compared to last year, creating potential value opportunities for well-positioned buyers—particularly those with stable employment and a long-term outlook. For example, Toronto’s condo market is facing a notable slowdown. Condominium apartment sales in the GTA dropped 21.7% in Q1 2025 compared to the previous year, according to the Toronto Regional Real Estate Board. Meanwhile, a study by Urbanation Inc. cited in the Financial Post reports that new condo sales in Toronto are plunging to levels not seen in nearly 30 years.

Of course, a new tariff policy has recently been announced on Canada by U.S. President Donald Trump, but the effects of that are yet to be known.

“Most housing markets continued to turn a corner in June, although market conditions still vary considerably depending on where you are in Canada,” said Valérie Paquin, Chair of CREA’s 2025-2026 Board of Directors and a REALTOR® based out of Blainville, Quebec. “If the spring market was mostly held back by economic uncertainty, barring any further big shocks, that delayed activity could very likely surface this summer and into the fall. If you’re looking to buy or sell a property in the second half of 2025, start planning with a REALTOR® in your area today.”

What trends are emerging in Canadian real estate?

CREA revised its 2025 forecast to reflect the tariff chaos and uncertainty that drove buyers back to the sidelines.

First, let’s look at prices.

The national average home price in Canada is projected to decline by 1.7% in 2025, settling at $677,368—roughly $10,000 lower than the forecast released in mid-April. The dip is largely driven by price declines in British Columbia and Ontario, the country’s two most expensive markets. Combined with slower sales activity in these provinces, their downturn is expected to offset modest price gains across the rest of the country.

Looking ahead to 2026, the national average home price is forecast to rise by 3% to $697,929. If realized, this would mark the sixth consecutive year where average prices have hovered around the $700,000 mark.

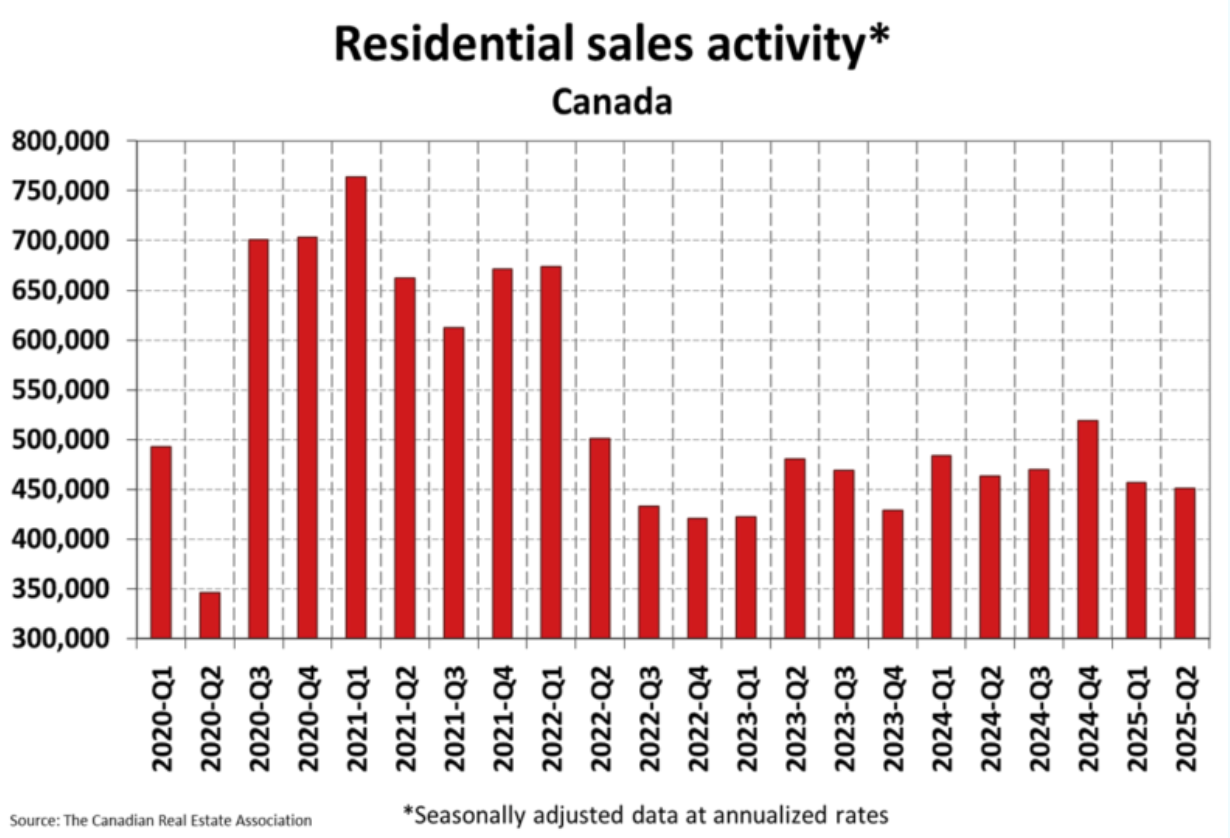

On the sales side, approximately 469,503 residential properties are expected to change hands through Canadian MLS® Systems in 2025—a 3% drop compared to 2024.

British Columbia, Alberta, and Ontario are the only provinces forecast to see sales declines this year, slightly offsetting gains in the rest of the country.

Looking ahead, national home sales are projected to rebound by 6.3% in 2026, reaching 499,081 transactions—bringing activity back in line with CREA’s earlier April forecast.

However, even with that recovery, 2026 would mark the fourth consecutive year in which national sales fall short of the 500,000 mark—a threshold that’s only been missed seven times since 2007.

CREA emphasizes that all projections remain subject to a high degree of uncertainty, given evolving market conditions.

Source: Day, Matt (2025). CREA Dials Back 2025 Housing Forecast: Canadian Home Sales Likely to Fall Short of 500,000 Again. Canadian Real Estate Association Cafe. Retrieved from https://www.crea.ca/cafe/crea-dials-back-2025-housing-forecast-canadian-home-sales-likely-to-fall-short-of-500-000-again/.