September 17th, 2025

Bank of Canada Delivers First Rate Cut Since March

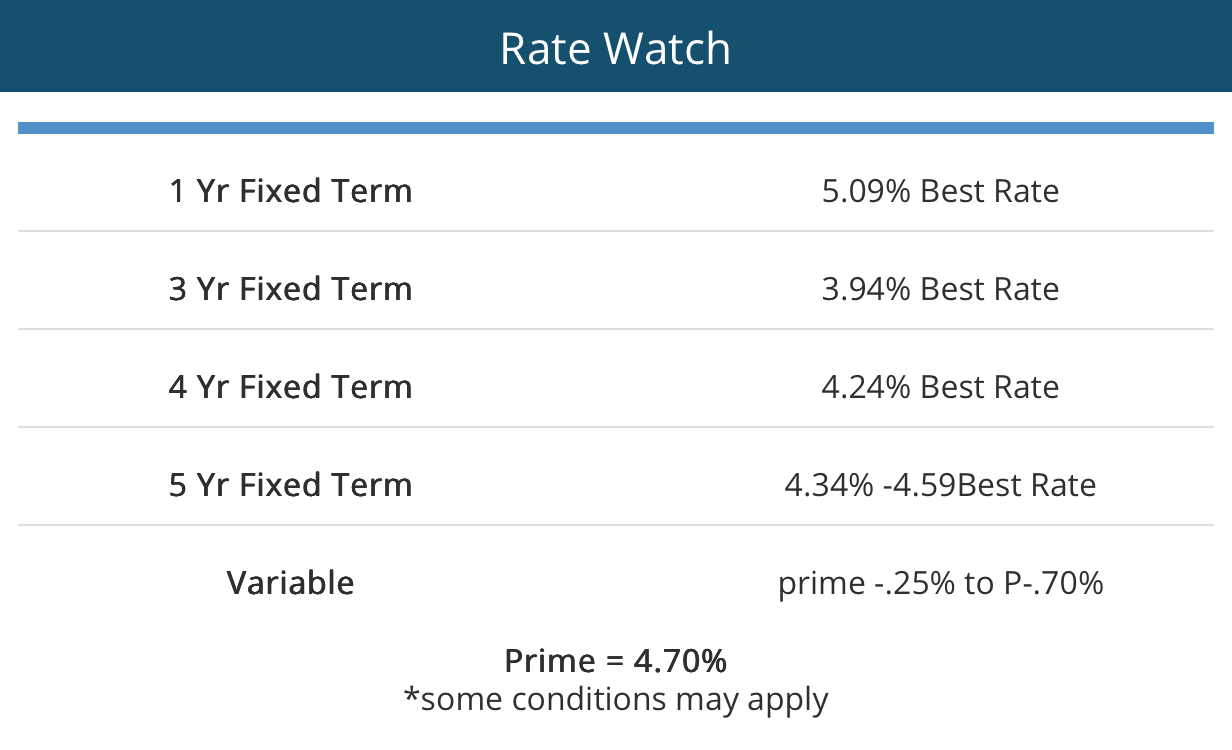

The Bank of Canada has cut its key interest rate by 25 basis points, bringing the benchmark down to 2.5% — and prime to 4.70%, the first reduction since March and the latest move in response to a slowing economy and trade-driven uncertainty.

This decision was widely expected after months of weaker economic signals. GDP contracted by roughly 1.5% in the second quarter, exports to the U.S. have fallen sharply, and the Canadian economy has shed more than 100,000 jobs in recent months. The unemployment rate has climbed above 7%, marking its highest level in nearly a decade outside the pandemic.

Why the Cut Happened

Governor Tiff Macklem pointed to three key factors behind the decision:

Softening labour market – Job losses in trade-sensitive industries and slower hiring across other sectors.

Cooling inflation pressures – Excluding gas, inflation has eased back toward the midpoint of the Bank’s 1–3% target range.

Trade and tariff risks – While the removal of most Canadian retaliatory tariffs has reduced some upside inflation risk, ongoing U.S. trade policies and Chinese tariffs continue to weigh.

“With a weaker economy and less upside risk to inflation, Governing Council judged that a reduction in the policy rate was appropriate to better balance the risks,” Macklem said.

Impact on Canadians

The immediate effect is lower borrowing costs. Commercial banks quickly followed suit, cutting prime lending rates by 25 basis points, which means relief for variable-rate mortgage holders and households carrying other floating debt.

Housing market activity, which had already shown signs of a mild recovery, could gain further momentum as financing becomes more affordable.

Still, not everyone is convinced the cut will be a game-changer. Some business leaders note that one small rate trim won’t suddenly drive new investments — but it does offer modest support for firms squeezed by tariffs and uncertainty

What’s Next?

Here’s where economists disagree. Some argue the Bank’s cautious tone signals hesitation about a rapid easing cycle. Others believe one cut is rarely the end — history suggests that once the Bank begins, more usually follow.

Money markets are pricing in the possibility of another cut as early as October, with further moves possible in December. Several big-bank economists expect the policy rate could drop to 2.25% before year-end if economic weakness persists.

For now, the Bank is emphasizing prudence, saying it will take decisions “one meeting at a time” while closely monitoring trade tensions, labour market health, and inflation trends.

Bottom Line

The rate cut provides immediate relief to borrowers and signals that the Bank of Canada is prepared to act again if needed. But with global trade disruptions still unresolved and Canada’s economy under pressure, uncertainty continues to hang over the outlook.

July 30th, 2025

Bank of Canada Holds Rate Again as Trade Tensions Cloud Outlook

The Bank of Canada met and held its overnight rate at 2.75% for the third consecutive meeting, as expected. But while the hold was widely forecasted, what’s behind the decision reflects deep uncertainty around trade, inflation, and future growth.

The central bank is navigating a tough environment—tariffs from the U.S. are in effect, and the threat of more looms large. Canada’s economy has shown some resilience, but cracks are visible. GDP growth slowed in Q2 after a strong Q1 that was driven by businesses front-loading exports ahead of tariff deadlines. At the same time, inflation remains elevated, particularly core CPI, and the labour market continues to surprise with strength. That combination is giving the Bank pause.

This time around, the Bank’s Monetary Policy Report didn’t include a conventional forecast. Instead, it outlined three possible trade scenarios: one assuming current tariffs hold, one assuming a de-escalation, and one in which tariffs rise further. In all cases, some level of tariff pressure persists.

Governor Macklem stressed that the Bank is prepared to act if the data turns. He laid out clear conditions: if economic weakness continues to suppress inflation and trade-related price spikes remain in check, rate cuts could follow. But for now, he’s standing firm—even as political pressure mounts.

Doug Ford and the CMBA-BC have both publicly called for rate relief. Mortgage brokers, in particular, argue that high borrowing costs are locking potential homeowners out of the market and undermining confidence. The CMBA-BC says a rate cut would help restore optimism and get sidelined buyers moving again.

From the Bank’s perspective, though, the risk of reigniting inflation still outweighs the political and economic pressure to ease. Inflation hit 1.9% in June, and underlying measures are closer to 2.5%. Until those numbers move convincingly lower—and trade tensions settle—rate cuts are not guaranteed.

Markets are now focused on the Bank’s next decision in September. While some economists think a cut is likely then, others say we’ll need multiple soft inflation prints before the Bank pulls the trigger. Either way, the message is clear: the BoC isn’t done yet, but it’s in no rush to mov

June 4th, 2025

The Bank of Canada held its benchmark interest rate steady at 2.75% for the second consecutive meeting, as policymakers grapple with the economic fog created by ongoing U.S. trade tensions and sticky inflation.

While the hold was widely expected, it still leaves many mortgage holders and real estate professionals frustrated. The Canadian Mortgage Brokers Association – BC summed it up best: caution may be prudent, but it’s not providing relief. With affordability stretched and real estate demand stalling, a rate cut could’ve offered some much-needed breathing room for borrowers.

So, why the hold?

Governor Tiff Macklem made it clear: “Uncertainty remains high.” While the economy posted better-than-expected Q1 growth at 2.2%, much of that came from businesses rushing to frontload exports before new U.S. tariffs kicked in — a temporary lift, not a long-term trend. The labour market has weakened, unemployment is up to 6.9%, and housing activity has cooled. Consumption is also losing steam.

On the inflation front, headline CPI dipped to 1.7% in April, largely due to the removal of the federal carbon tax. But dig deeper, and the picture changes: core inflation rose to 2.3%, with business surveys pointing to further price hikes as tariffs bite. The Bank acknowledged this “unexpected firmness” in inflation, which gives them reason to pause before easing further.

And then there’s trade. U.S. tariffs — some now as high as 50% — have introduced significant volatility. While negotiations have softened some of the worst-case fears, nothing has been resolved. The Bank is opting for a cautious, data-dependent approach while they “gain more information.”

Still, most economists agree that rate cuts are likely coming — possibly as soon as the July 30 announcement. The OECD forecasts Canada’s growth slowing to just 1% this year, with inflation pressures expected to fade as economic momentum stalls. Even the Bank of Canada hinted that there’s room to cut if trade tensions drag on and demand continues to soften.

For now, variable-rate mortgage holders won’t see a change, with prime holding steady at 4.95%. But fixed rates, already elevated due to surging bond yields tied to global uncertainty, remain a pain point for borrowers.

Bottom line: the Bank is trying to thread a needle — holding off inflation without pushing the economy into recession. But with consumer confidence down, housing investment lagging, and trade risks unresolved, the pressure to act may soon be too strong to ignore.

April 16th, 2025

The Bank of Canada held its overnight rate at 2.75%, ending a streak of seven consecutive cuts.

While the pause wasn’t unexpected, it’s not necessarily permanent. Uncertainty surrounding escalating U.S. tariffs has left the Bank in wait-and-see mode, unwilling to commit to a clear path forward.

The central bank emphasized just how murky the outlook has become, scrapping its usual economic forecast in favour of two scenarios: one with a moderate rebound and one with a deep recession triggered by a global trade war. Both options highlight the challenge policymakers face—balancing weakening domestic demand with the potential inflationary impact of tariffs.

Bank of Canada Governor Tiff Macklem called the current environment a “seismic shift in U.S. trade policy,” admitting that recent developments make it unusually difficult to predict inflation or GDP growth. Inflation came in at 2.3% in March—lower than February but still elevated from earlier in the year. That figure is expected to drift lower in the coming months as carbon tax removals and falling oil prices work their way through the system.

Still, risks are rising. Canadian employment fell in March, business investment is slowing, and consumer spending is soft. Economists at RBC, CIBC, TD, and BMO now largely agree that more rate cuts are likely—most are pointing to June as the next move. But how deep those cuts go will depend on how the trade story evolves.

With inflation and growth pulling in opposite directions, the Bank’s job isn’t getting any easier. But one thing is clear: if economic conditions worsen, rate cuts will be back on the table—likely sooner than later.

March 12th, 2025

The Bank of Canada (BoC) has cut its benchmark interest rate by 25 basis points to 2.75%, marking the seventh consecutive reduction since mid-2024.

This decision comes amid growing economic uncertainty, primarily due to U.S.-imposed tariffs and potential trade conflicts. The move is aimed at mitigating financial pressures on Canadians, particularly mortgage holders and homebuyers.

Economic Justification

Canada’s economic growth showed resilience in late 2024 but is now expected to slow due to trade tensions with the U.S. Inflation remains close to the BoC’s 2% target, but the end of temporary tax breaks is expected to push inflation to 2.5% by March. Business and consumer confidence have been shaken, causing a drop in spending and investment.

Impact on Homeowners and Buyers

Lower rates will reduce borrowing costs, making variable-rate mortgages and Home Equity Lines of Credit (HELOCs) more affordable. Increased affordability could drive demand in the housing market, potentially raising home prices.

Fixed-rate mortgage holders may not see an immediate impact, but bond yields may adjust over time lowering rates.

What’s Next?

More rate cuts could follow in 2025 if economic conditions deteriorate. Some analysts predict the BoC’s rate could fall to 2.25% by mid-year. The BoC acknowledges that while monetary policy can help cushion the impact of trade disruptions, it cannot fully offset them.

January 29th, 2025

A new year starts with a rate reduction!

The Bank of Canada Cuts Rates Again – But Trade War Risks Loom Large

The Bank of Canada (BoC) has lowered its benchmark rate by 25 basis points to 3.00%, marking the sixth consecutive rate cut amid signs of slowing economic growth and moderating inflation. While inflation remains near the central bank’s 2% target, concerns over a potential trade war with the U.S. have clouded the economic outlook.

The biggest wildcard? U.S. President Donald Trump’s threat to impose a 25% tariff on all Canadian imports, which could take effect as early as February 1. If enacted, these tariffs would significantly disrupt trade, potentially pushing Canada into a recession while also driving up inflation due to higher import costs.

The BoC has modeled several scenarios, with estimates suggesting that a full-blown trade conflict could shave up to 3 percentage points off GDP growth in the first year. In response, the Bank may be forced to cut rates more aggressively throughout 2025, possibly lowering the benchmark rate to 2.25% or lower before year-end.

What This Means for Real Estate and Borrowers

With rates dropping further, homebuyers gain more purchasing power, likely fueling demand and putting upward pressure on home prices. If you’re considering buying, refinancing, or selling, now is a crucial time to assess your options.

The BoC has signaled it will continue adjusting rates as needed to keep the economy stable, but a prolonged trade war could change the game completely.

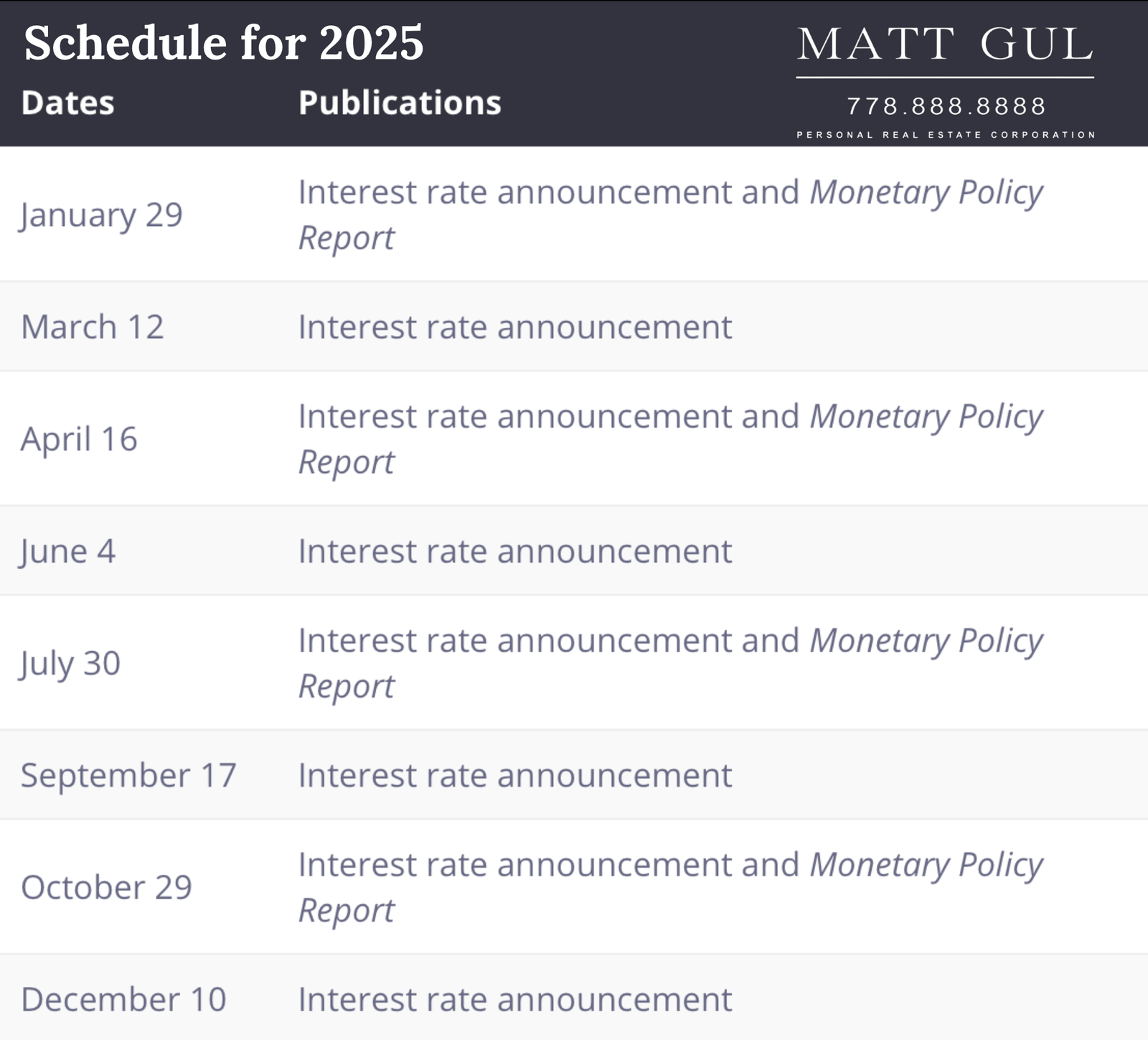

Bank of Canada Interest Rate Announcement Dates / 加拿大央行利率公佈日期

- January 29 -0.25

- March 12 -0.25

- April 16 +0.00

- June 4 + 0.00

- July 30 + 0.00

- September 17 -0.25

- October 29

- December 10

If you are interested in selling or purchasing a property, please contact Matt Gul, one of West Vancouver's top Realtors at 778-888-8888, for Mortgage Advice, please contact Dave Bruynesteyn at 604-315-3283 and mention that you've been referred by Matt Gul.

***For Previous Bank of Canada Interest Rate Announcements, Please Click Here***