The rekindling of Canadian housing market activity is still on pause, says the Canadian Real Estate Association (CREA) following the release of its latest national housing data.

In fact, home sales, new listings, prices, and market conditions are about as “flat as a pancake,” according to Shaun Cathcart, CREA’s Senior Economist.

“The bigger picture is a market still stuck in the same holding pattern it’s been in since the beginning of the year.” Cathcart said in CREA’s monthly Housing Market Report (Day, 2024).

"And why is that? With interest rates continuing to decline and the Bank of Canada signaling there will be more cuts to come in 2025, Canadians have been biding their time when it comes to buying properties. A recent report from RE/MAX ( also summarized by Matt Gul Here) shows 16% of Canadians said they would feel more comfortable entering the real estate market if they see the Bank of Canada’s key interest rate drop 1% (100 basis points—the last three interest rate cuts have all been 25 basis points each) by the end of the year."

“With ever more friendly interest rates now all but guaranteed later this year and into 2025, it makes sense that prospective buyers might continue to hold off for improved affordability, especially since prices are still well behaved in most of the country” said Cathcart.

August home sales & what the future holds

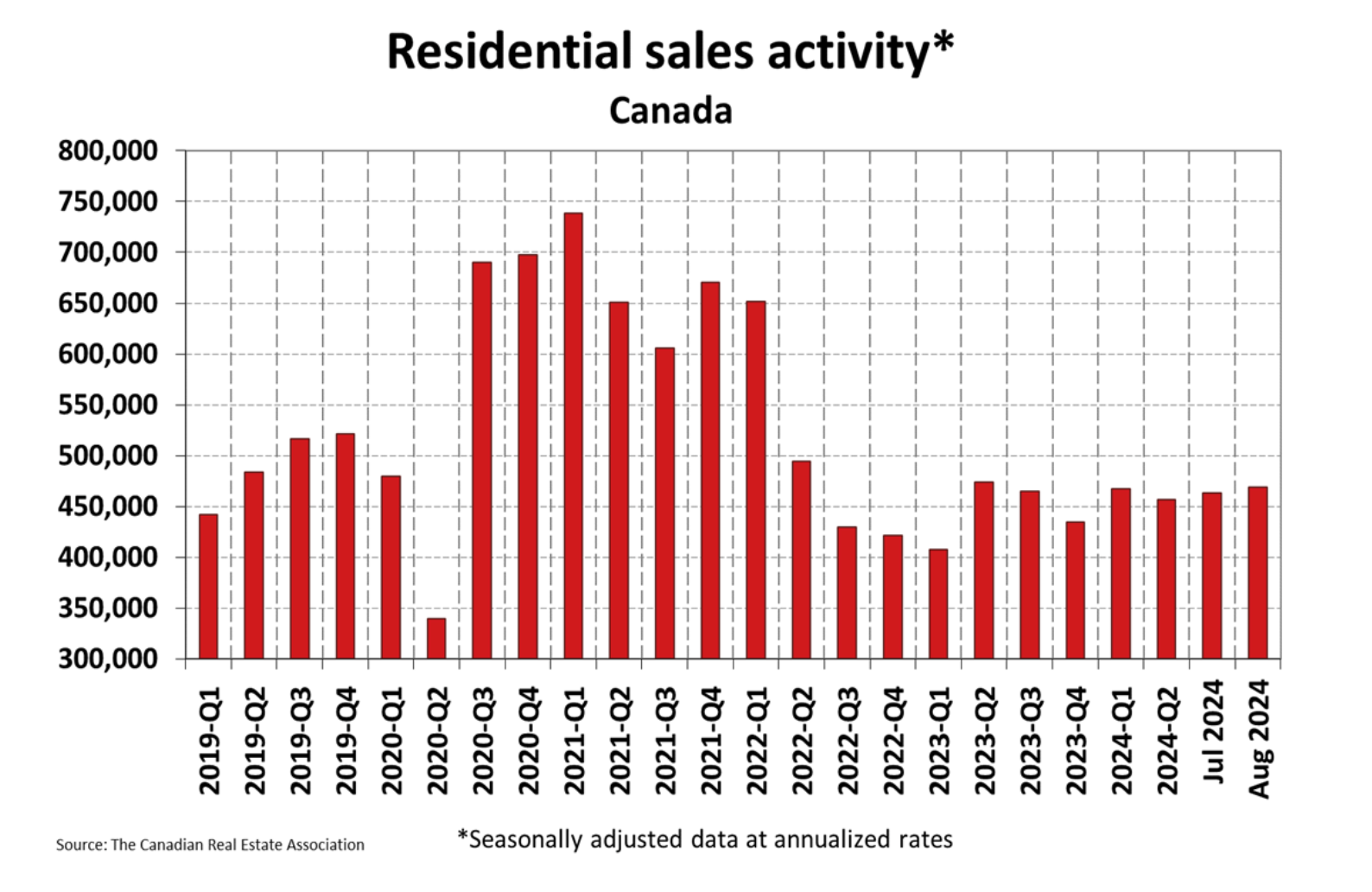

Although the housing market has been analyzed as flat, there have been some minor movements. Canadian home sales increased by 1.3% in August compared to July, reaching their highest level since January, while the number of new listings rose by 1.1%.

With sales rising slightly more than new listings in August, the national sales-to-new listings ratio edged up to 53%, a level that has remained relatively stable since April. The long-term average for this ratio is 55%. Generally, a ratio between 45% and 65% indicates balanced market conditions.

“Declining interest rates are poised to activate the market soon,” stated Cathcart in CREA’s Housing Market Report. “As I mentioned last month, while the precise timing remains somewhat uncertain, the overall forecast for a revitalized housing market within the next year is highly promising.” He also pointed out that typically, four key periods each year—early April, May, June, and September—tend to encourage people to enter the market.

Day, Matt (2024). Canadian Real Estate Activity ‘Flat as a Pancake’ in August. Canadian Real Estate Association. Retrieved from https://www.creacafe.ca/canadian-real-estate-activity-flat-as-a-pancake-in-august

Home prices stay put

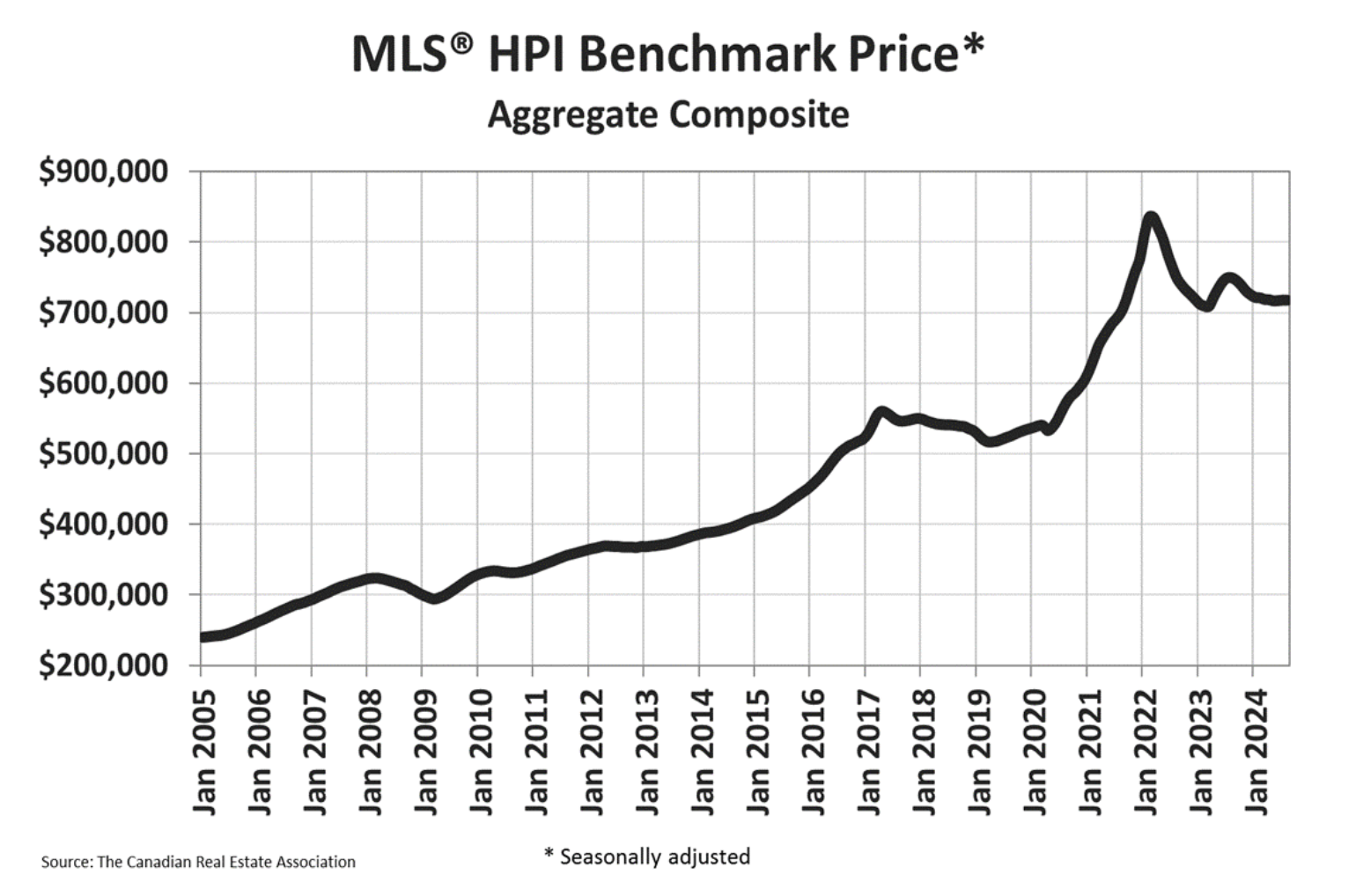

"The National Composite MLS® Home Price Index (HPI)— an exclusive tool REALTORS® use to gauge a neighbourhood’s home price levels and trends most accurately—was unchanged from July to August, following two small increases in June and July.

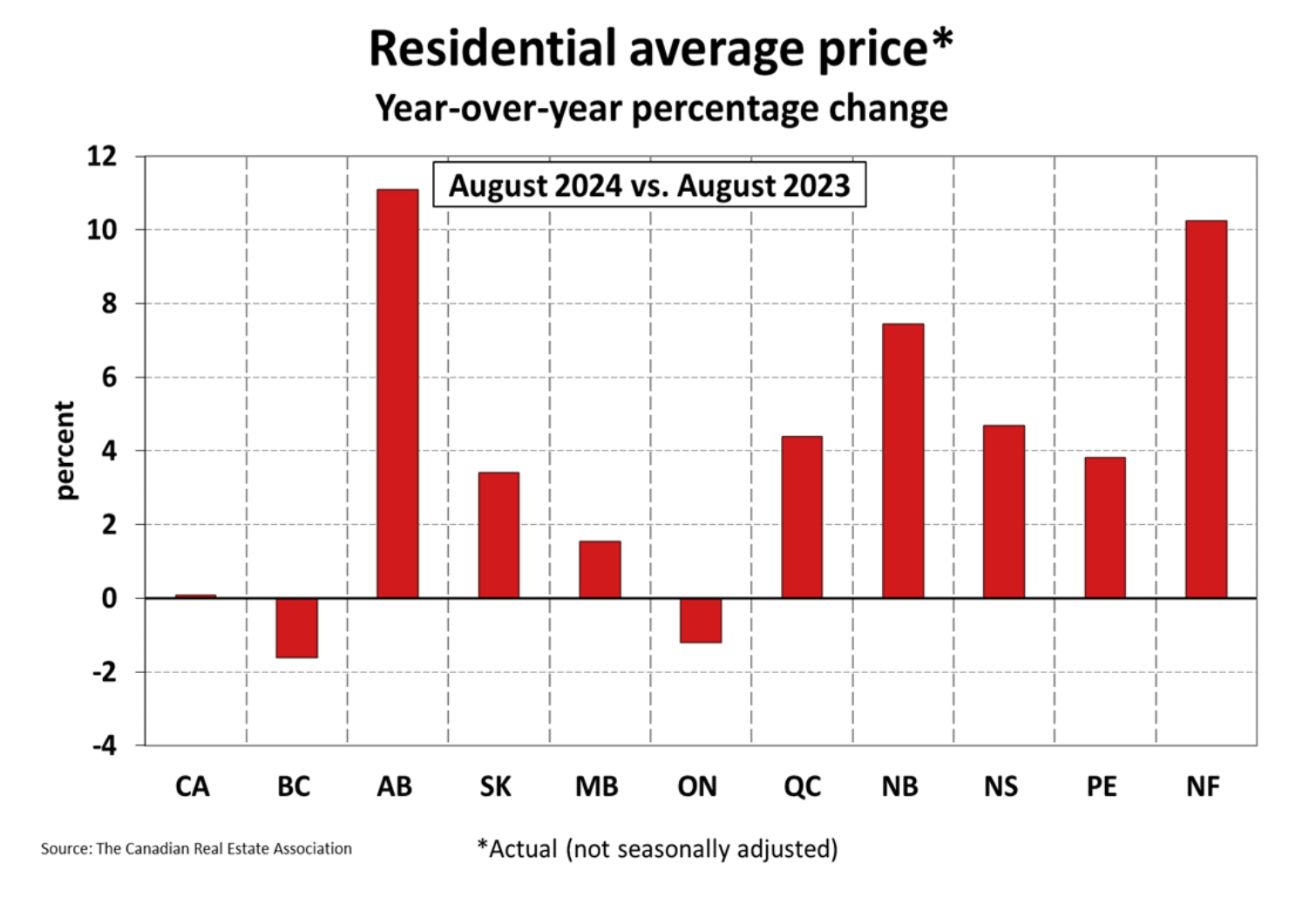

That said, the bigger picture is how prices at the national level have been basically flat since the beginning of 2024 and when doing current year-over-year comparisons. The actual (not seasonally adjusted) national average home price was $649,100 in August 2024, almost unchanged (up by just 0.1%) from August 2023" (Day, 2024).

If prices remain mostly flat, interest rates continue coming down, listings continue ramping up, it’s not out of the question to think there will be a sweet spot for aspiring home buyers in the near future.

Day, Matt (2024). Canadian Real Estate Activity ‘Flat as a Pancake’ in August. Canadian Real Estate Association. Retrieved from https://www.creacafe.ca/canadian-real-estate-activity-flat-as-a-pancake-in-august