Luxury home-buying activity in most markets across the country are slowly shifting into high gear as buyers reap the benefits of softer housing values.

"The 2024 RE/MAX Canada Spotlight on Luxury Report examined luxury home-buying activity in 10 markets across the country in the first two months of the year and found that, despite a disconnect between buyers looking for deals and sellers’ price expectations, almost all regions reported a strong start to the year."

3930 Bayridge Avenue, West Vancouver | Listed by Matt Gul and Selin Gul

KEY FINDINGS

Condo Sales:

Condominium sales are up almost 70% in Greater Vancouver. 27 strata condo sales averaging $4 million were recorded between January 1 and February 29 of this year. In contrast, there were 16 sales during the same period in 2023, with an average price of $4.5 million.

Multiple Offers:

Multiple offers occurring in Calgary; some homes selling sight unseen. Some multiple offers are occurring in Saskatoon, although at the lower price points. This may filter upward in coming months.

Sales Growth:

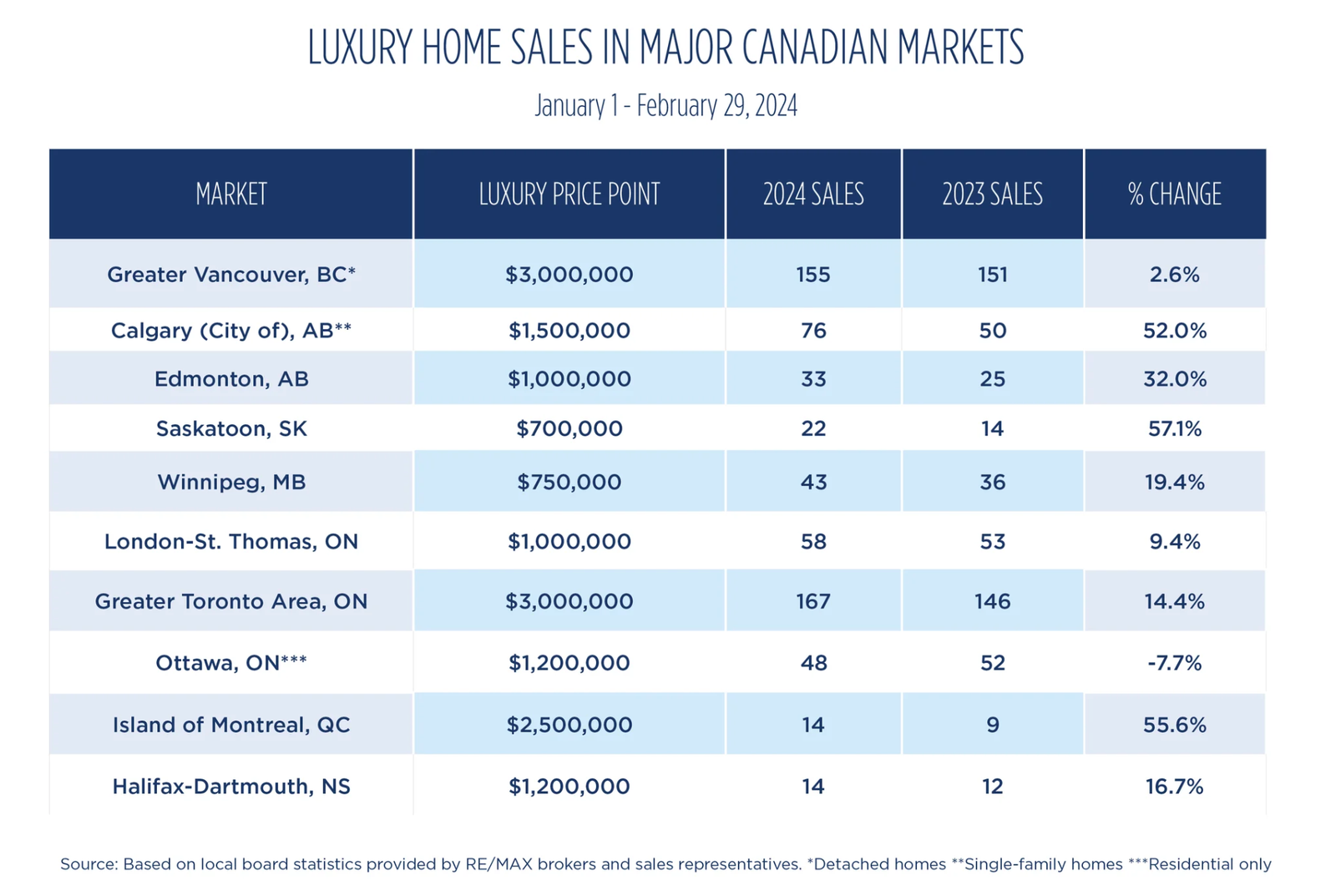

Double-digit sales growth was seen in 7/10 markets. These include Saskatoon (57%), Montreal (+55.6%), Calgary (+52%), Edmonton (+32%), Winnipeg (+19.4%), Halifax (+16.7%) and Toronto (+14.4%).

Affordable Luxury:

Alberta markets remain strong. Calgary and Edmonton have been bolstered by affordability.

Uber Luxury:

The uber-luxe market heats up in Toronto, cools in Vancouver. The Greater Toronto Area experienced a 77% jump in sales over $5 million, split fairly evenly between the 416 and 905 regions. On the west coast, demand for uber-luxe properties has fallen year-over-year, largely attributed to the Foreign Buyer Ban.

Inventory:

Inventory in Toronto is tight in many hot-pocket areas. However, values are being held in check for the most part, for now.

Data Source: RE/MAX CANADA

"Lower overall values, strong equity gains and downward trending interest rates are supporting demand for luxury product including freehold and condominium properties in markets across the country. While a disconnect is somewhat hampering activity in larger markets, with sellers holding out for Covid-era values and buyers seeking bargains, those serious about making moves are finding common ground. An ample supply of product exists in most markets, although some neighbourhoods are experiencing exceptionally low inventory levels at sought-after price points. An influx of fresh, new properties in the spring will renew buyer interest and activity, but chronic supply issues will likely persist at the entry level to luxury" (RE/MAX CANADA, 2024).

SHIFTS IN THE LUXURY HOUSING MARKET

Luxury home-buying activity is also undergoing change as a younger demographic moves into the upper end of the market. Demand is strongest for newer, well-appointed homes in traditional hot pockets. Turnkey properties are most coveted, although there are some buyers that are willing to renovate. The desire for more space and less congestion is once again an emerging trend, as acreage properties boasting large homes in suburban-rural or rural areas experience an upswing in popularity in London, Ottawa, Edmonton and Saskatoon. Building activity is also making a comeback, with new construction and infill on the rise in half of all markets examined.

Some luxury buyers looking to expand their purchasing power are moving over into markets such as London (drawing buyers from the Greater Toronto Area), Halifax, Calgary, Edmonton and Saskatoon (drawing buyers from Ontario and British Columbia). However, activity among foreign buyers has fallen dramatically since the introduction of the Foreign Buyer Ban by the Federal Government in January 2023, which it extended through to early 2027. The impact has been palpable in the uber-luxe segment of major markets, such as Metro Vancouver and Toronto, as well as the condominium market in the City of Montreal.

Condominiums have been a popular option this year, despite single-detached homes comprising the lion’s share of luxury sales. Condo activity was strongest in Metro Vancouver, where sales climbed close to 70 per cent in the first two months of the year (27 versus 16). Solid condominium activity at the high-end price points was also reported in London, fuelled by empty nesters and retirees, and in Ottawa and Montreal. Halifax, which has limited condo product in the top end, has already recorded four sales to date. Some baby boomers in Saskatoon are also opting to downsize from larger homes in high demand areas to newer luxury condominiums in the core.

“Buyer enthusiasm is evident as the spring market ramps up,” says Alexander. “Yet, despite the uptick, we’re still seeing some factors constraining sales at luxury price points. Most significant is the tax implications at the uber-luxe levels, which have been weighing down the segment, particularly in the Greater Toronto Area.”

On the sale of a $4 million home in Vancouver, for example, buyers will pay $90,000 in land transfer taxes. On the sale of a property of similar value in the City of Toronto, land transfer taxes will set buyers back close to $183,000. While sale under $7.5 million remain surprisingly resilient, only one sale has occurred over that threshold (and it was not located in the City of Toronto). The adjustment to higher taxation levels has been slow, but it is being offset somewhat by pent-up demand, with some deciding they can only hold off for so long. Others, meanwhile, are reluctant to list their properties, impacting supply, or are choosing to renovate rather than take a substantial tax hit.

MARKET-BY-MARKET

VANCOUVER, BC

Although softer housing values and greater selection have bolstered sales of detached homes over $3 million in the luxury segment of the Metro Vancouver market in the first two months of the year, strata condominium sales have taken the lead in terms of percentage increases, with sales volumes up 68 per cent year-over-year.

CALGARY, AB

Calgary’s juggernaut real estate market continues to advance, with home-buying activity at the top end of the market climbing 52 per cent in the first two months of 2024. Seventy-six single family homes changed hands over $1.5 million between January 1 and February 29, up from 50 properties during the same period in 2023. Nearly 60 per cent of sales took place in February

GREATER TORONTO AREA, ON

The Greater Toronto Area’s (GTA) luxury market has sprung back to life in the first two months of the year, with home sales over the $5 million price point leading the way. Thirty-two freehold and condominium properties changed hands between January 1 and February 29, up 77 per cent from the 18 sales reported during the same period in 2023. Of the 32 properties sold over $5 million to date, 17 sales occurred in the 416, while 15 were in the 905.

MONTREAL, QC

Strong activity early in the year has set the stage for a robust spring housing market in the City of Montreal’s luxury sector. Year-to-date (January 1 – February 29) sales priced over $2.5 million have increased 55 per cent, with 14 freehold and condominium properties changing hands so far this year, compared to nine during the same period in 2023.

MATT GUL GROUP | RE/MAX MASTERS REALTY