Luxury home buyers in Toronto will now face a substantial increase in municipal land transfer taxes, with rates escalating based on property values.

Effective Monday, the tax hike primarily impacts properties exceeding C$3 million (US$2.2 million), potentially causing a temporary slowdown in the city's luxury real estate market. This move, approved by the Toronto City Council in September to bolster the city's budget, has been met with criticism.

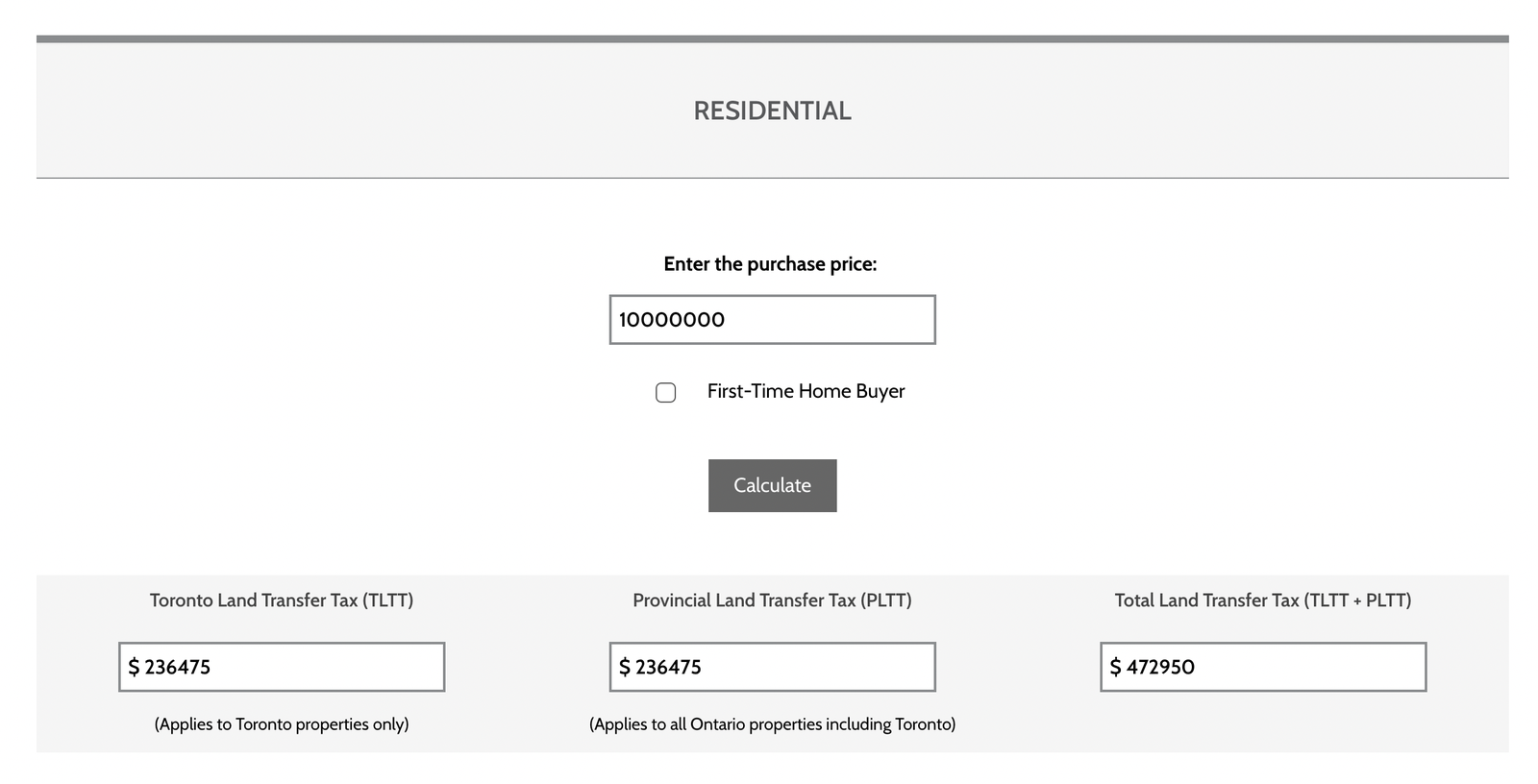

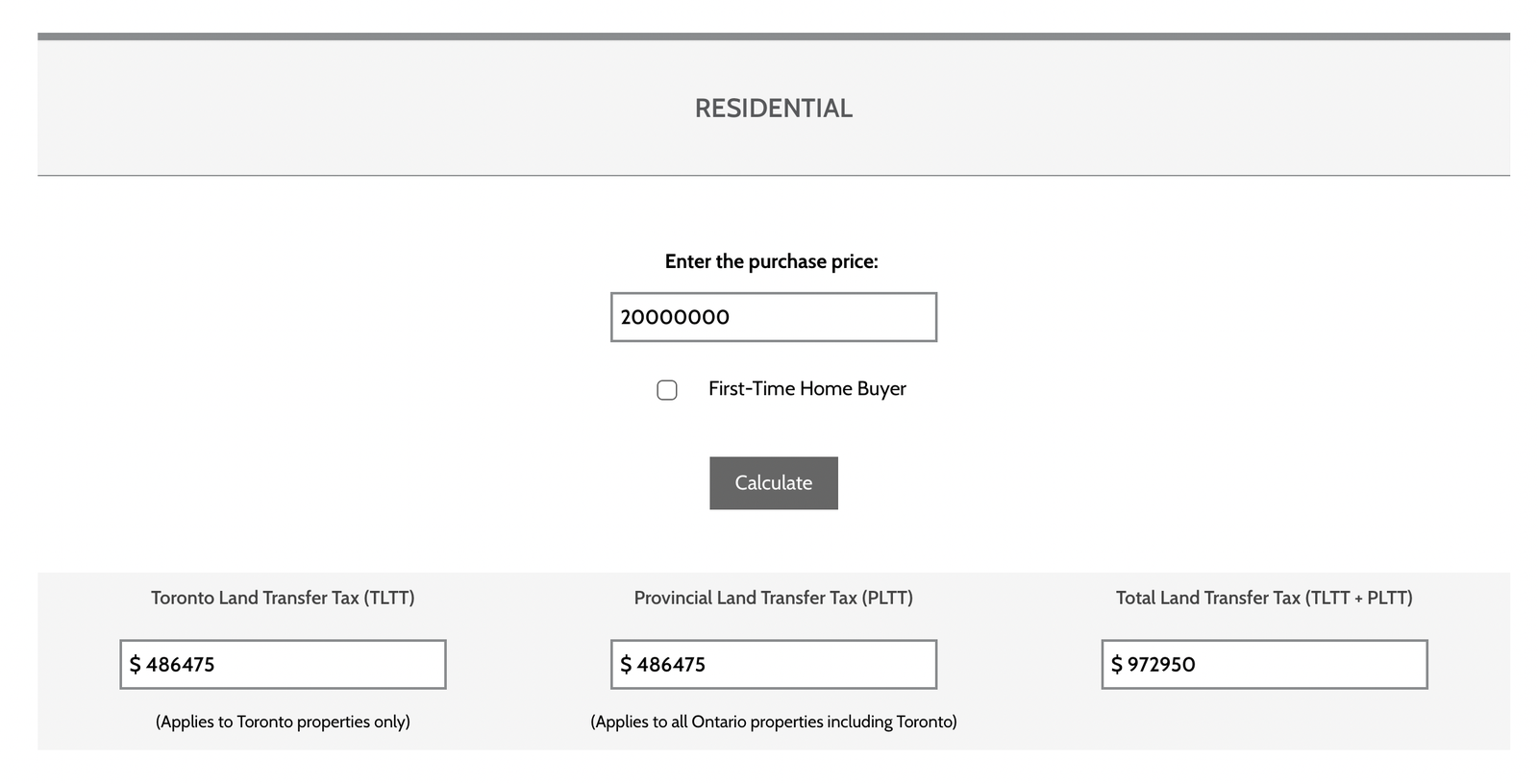

According to Mike Clark, a real estate lawyer at Toronto firm Korman and Co., instead of a tax of 2.5% for any property over C$2 million, the top rate will now reach 7.5% for homes worth more than C$20 million. As a result, a buyer purchasing a C$20 million house will incur a one-time transfer tax of C$1.5 million, a significant jump from the C$500,000 paid in 2023.

↓↓↓ Scroll for Vancouver vs. Toronto Property Transfer Tax Comparison ↓↓↓

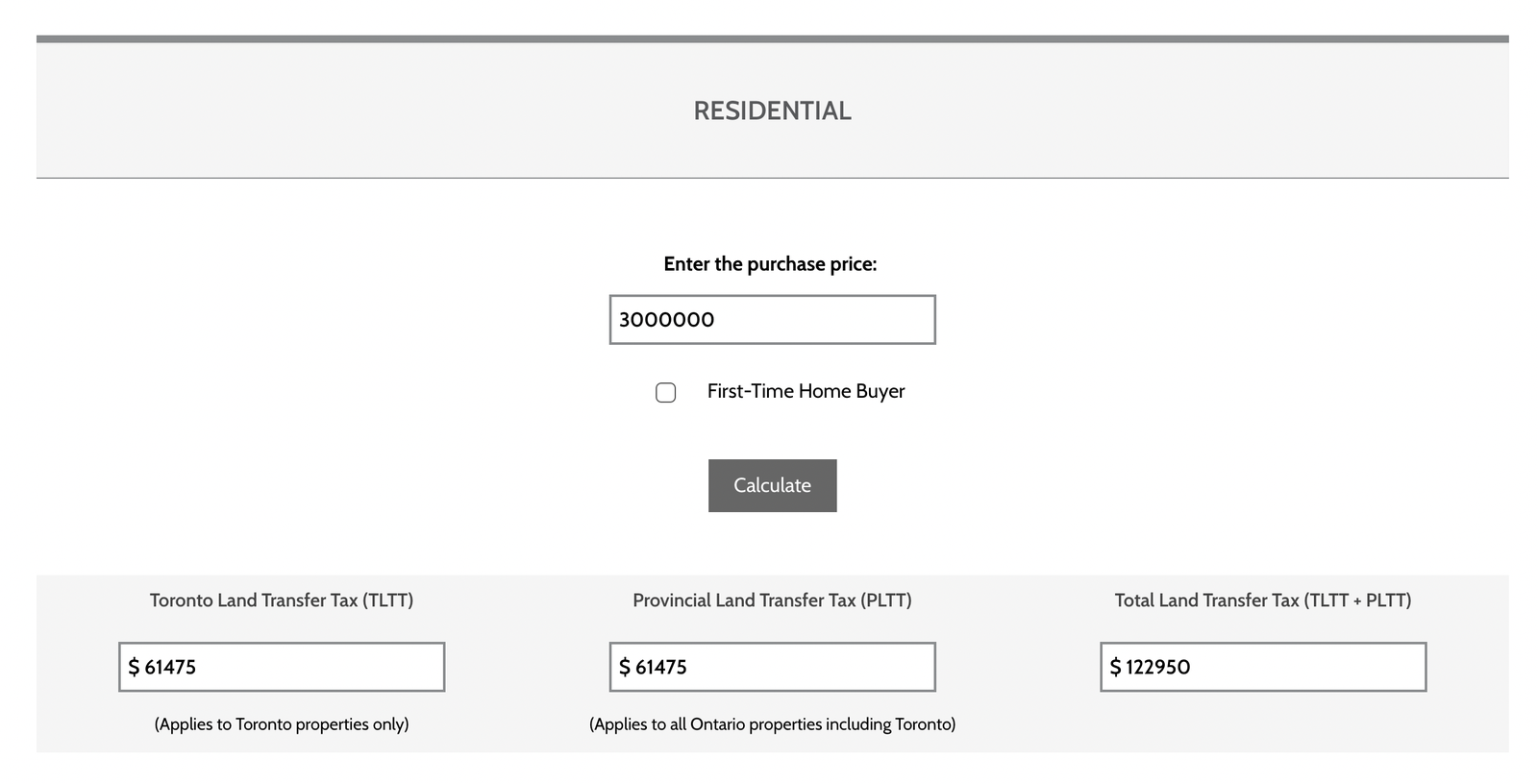

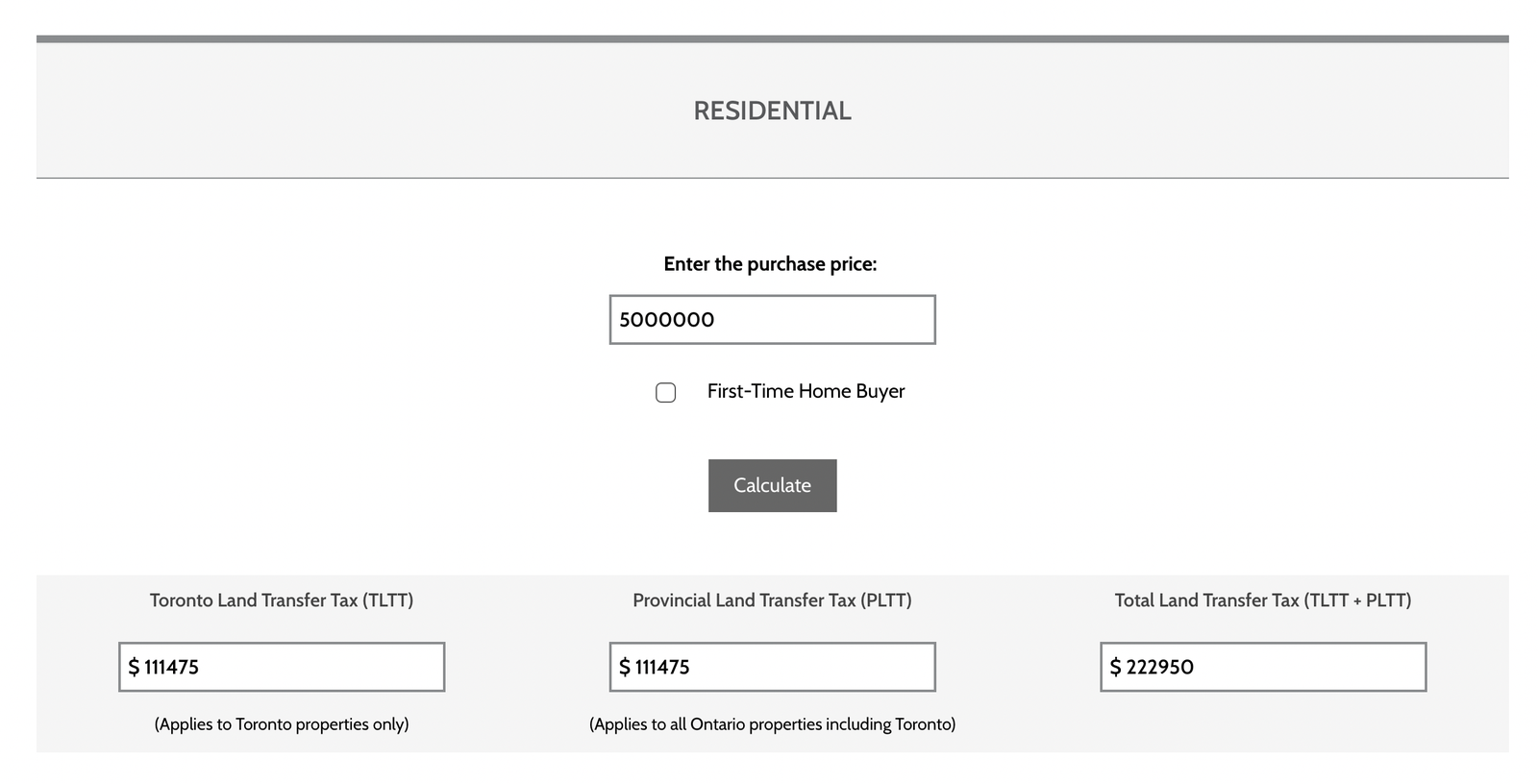

Ontario's 2.5% land-transfer tax, applicable to all home buyers in the province, remains unchanged. Toronto stands alone among Ontario cities in imposing an additional municipal land transfer tax.

The new tax structure is progressive, starting at 3.5% for homes valued at C$3 million and gradually increasing to the 7.5% rate.

“A few people who were contemplating larger purchases moved them forward. I had one guy at C$3 million who didn’t care,” he said. “A lot of my clients at the high end are showing up with huge amounts of cash, so the tax is annoying, but they’ve got the money” Clark said (Kaminer, 2024).

Critics, including Paul Baron, president of the Toronto Regional Real Estate Board (TRREB), argue that upfront land transfer taxes disadvantage home buyers.

“Our position has always been that the concept of a land transfer tax doesn’t benefit home buyers, due to the unfair nature of the tax, which has to be paid upfront,” he said in an e-mail.

According to global tax consultancy UHY, Belgium has the highest average property purchase taxes of any country for real estate worth the equivalent of US$1 million, at 11.3%. The global average is 3.3% for properties in this price bracket, UHY noted. The U.S. levies just 0.6% on average and―in contrast with its largest city―Canada charges an average 1.8% (Kaminer, 2024).

The new tax measures may potentially benefit neighbouring municipalities like Mississauga and Oakville, situated just outside Toronto, as they do not impose their own land-transfer taxes.

Despite concerns about the increasing tax burden, industry experts like Jordan Weinberg, a partner at Toronto accounting firm MNP, believe that buyers will eventually perceive these taxes as the "cost of doing business."

The broader effect is that “local taxes seem to be ramping up on targeting high-income earners,” Weinberg said. In January, Toronto is also tripling its so-called Vacant Home Tax to 3% of a home’s value; the tax affects homes that are not principal residences and unoccupied more than six months in a year. According to the CBC, the city is also considering a separate land transfer tax on foreign buyers (Kaminer, 2024).

In the long run, industry specialists, such as Joanna Lang of Outline Financial, anticipate that while luxury home purchases may become more expensive and challenging, buyers' strong preferences for specific neighborhoods will likely outweigh the impact of the increased tax rates on their decisions.

Any questions? Call or Email Matt Gul, West Vancouver Luxury Waterfront Homes Realtor at 778.888.8888 or matt@mattgul.com

If you would like to learn more about the Property Tax Increase and how it affects your home buying or selling plan, please don't hesitate to reach out to top West Vancouver Waterfront Realtor, Matt Gul with any of your questions regarding buying or listing your home and any questions relating to how the items in this article may impact your decision.

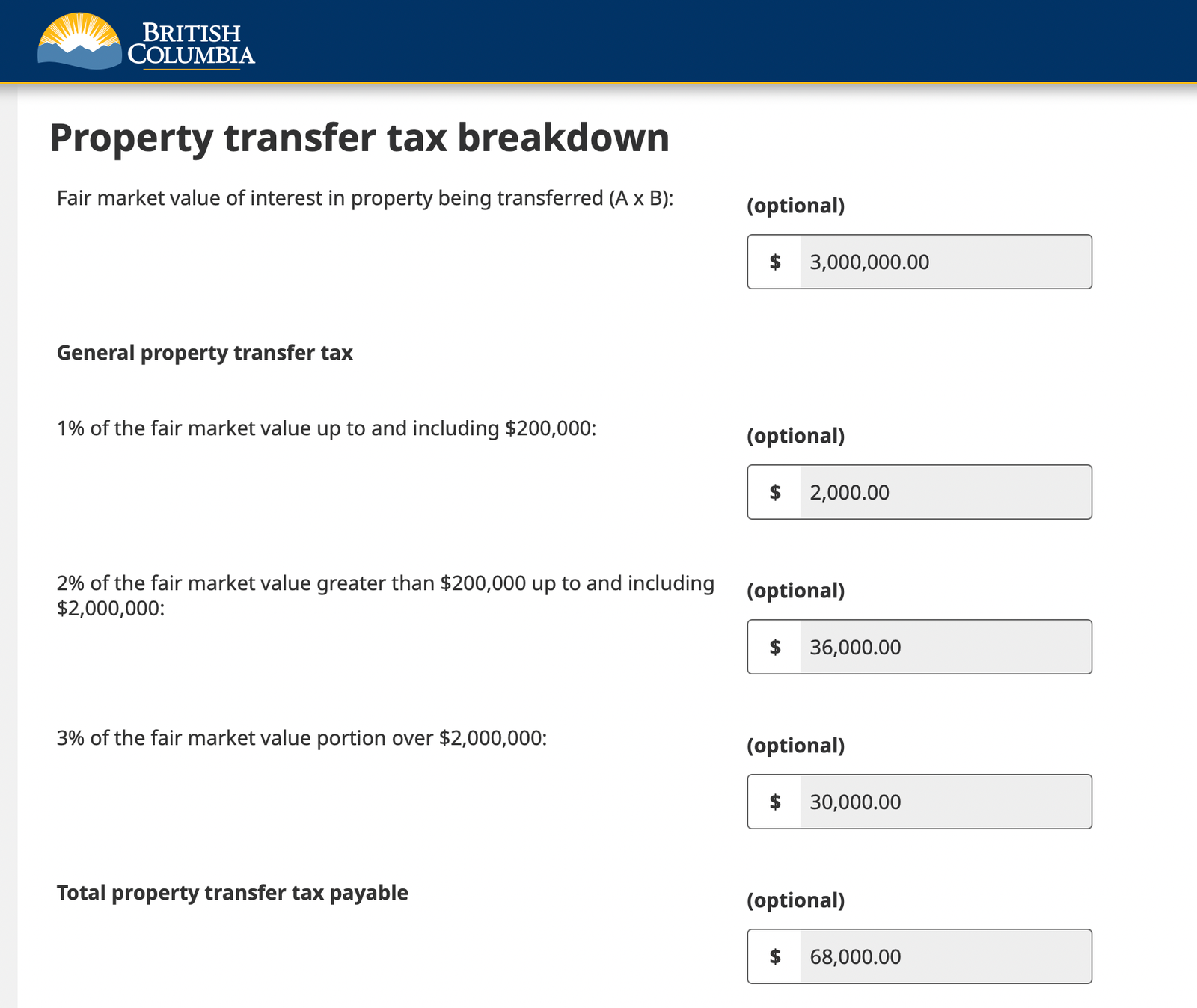

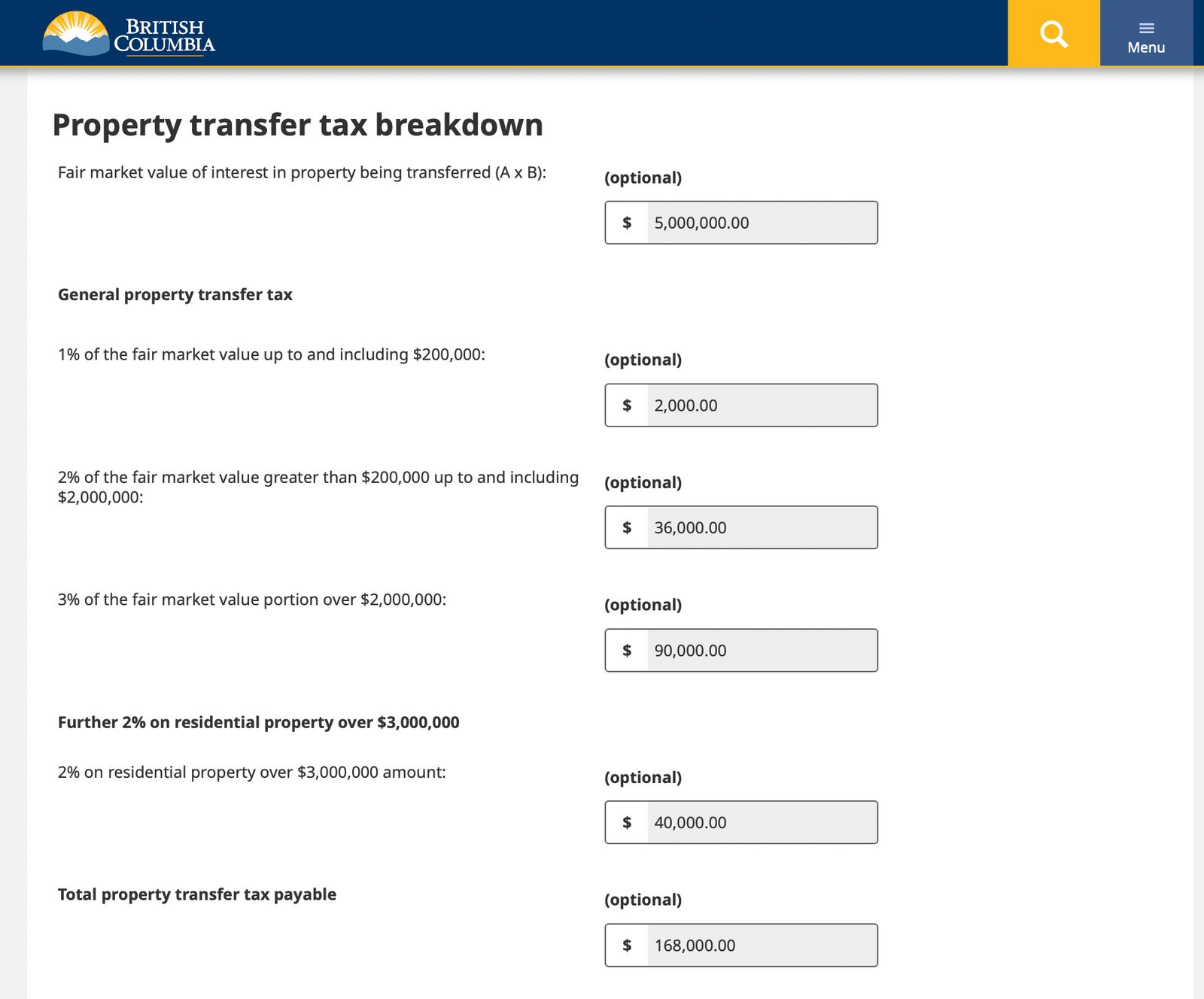

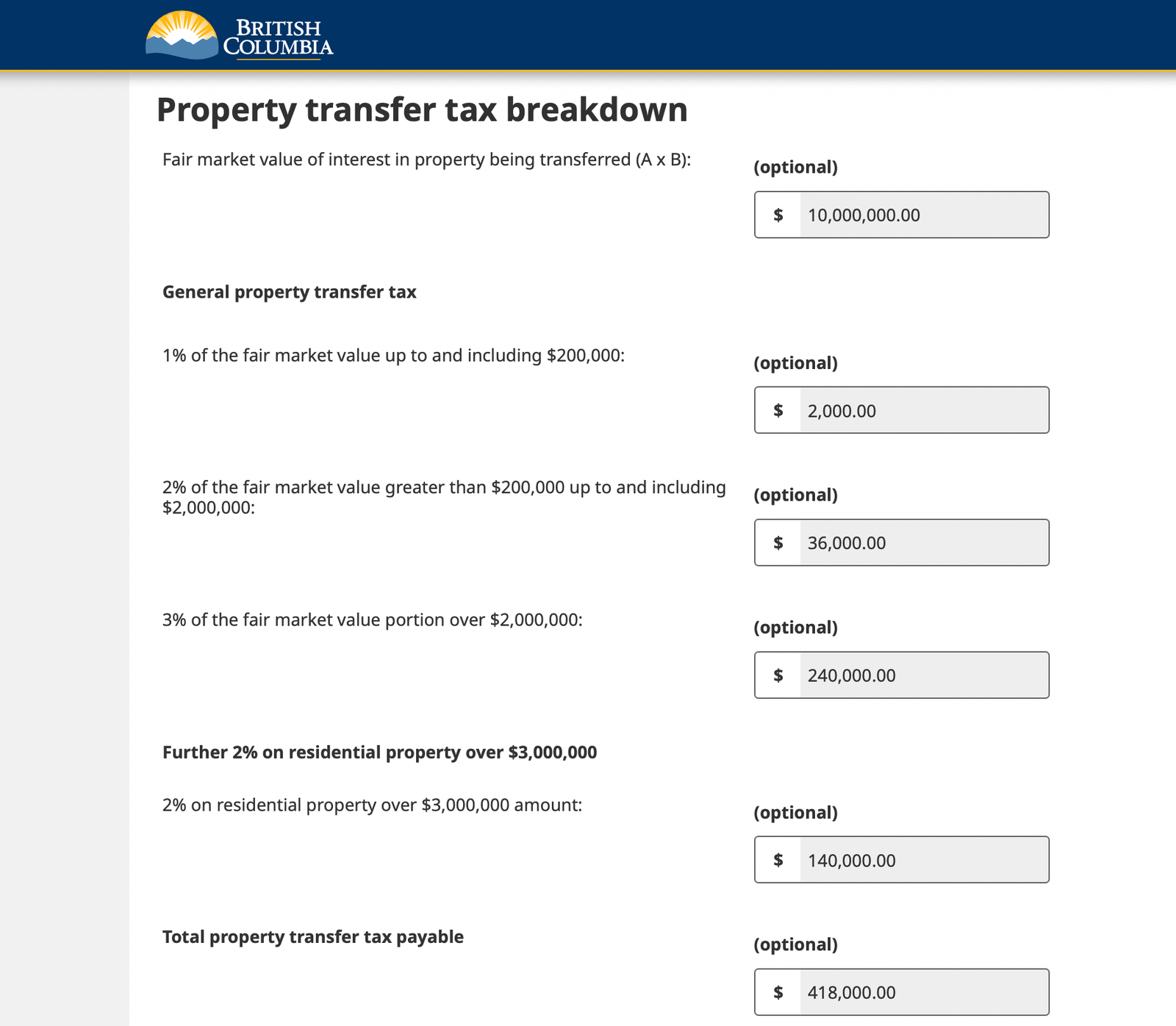

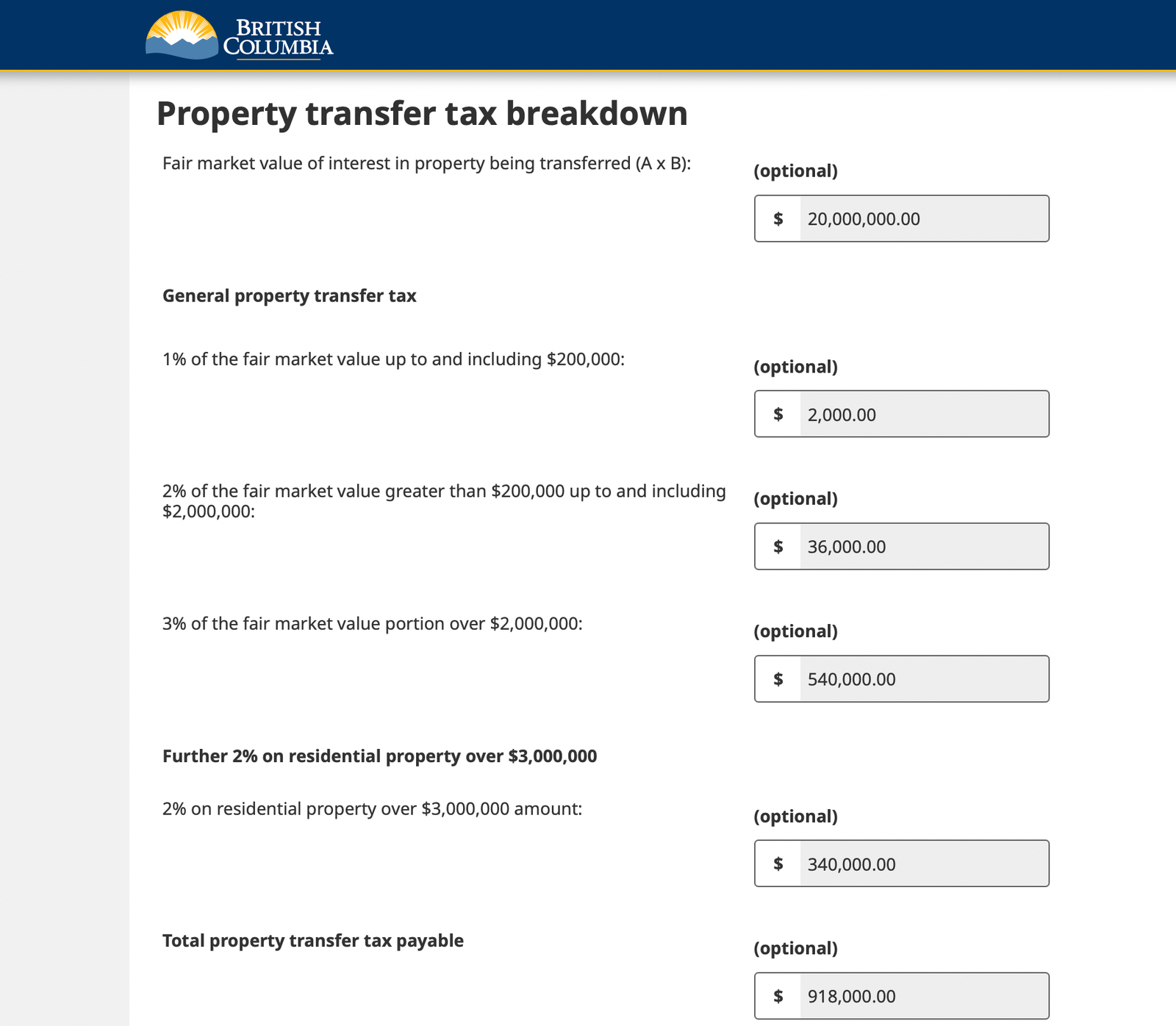

British Columbia Property Tax

Ontario + Toronto Property Transfer Tax

Michael Kaminer, 2024 | Mansion Global