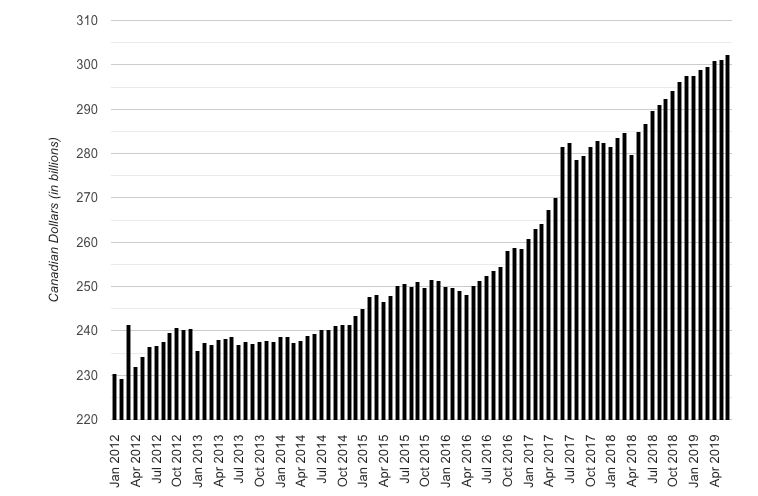

Above is a photo of the total amount of loans that is secured with Residential Real Estate.

Canadian real estate owners are back to borrowing against their home equity. Office of the Superintendent of Financial Institutions (OSFI) filings show the balance of home equity lines of credit (HELOC) debt reached a new high in June. Growth is no longer near the peak seen a couple of years ago, but still much higher than usual.

Canadian HELOC Debt Rises To Over $302 Billion

The balance of real estate used to secure loans has recently topped its previous record at a brand new all-time high, and the growth rate is still rising in higher than historic levels. The balance of loans reached a sum of $302.23 billion CAD in June up 0.35% month-over-month. This represents an increase of 5.37% year-over-year.

Although the rate of growth is not at its current year peak, however it still remains higher than last year. The 12-month pace of growth in June fell for a second consecutive month. The 12-month increase is almost twice the pace of growth seen during the same month last year. The growth rate is still below the peak seen in 2017.

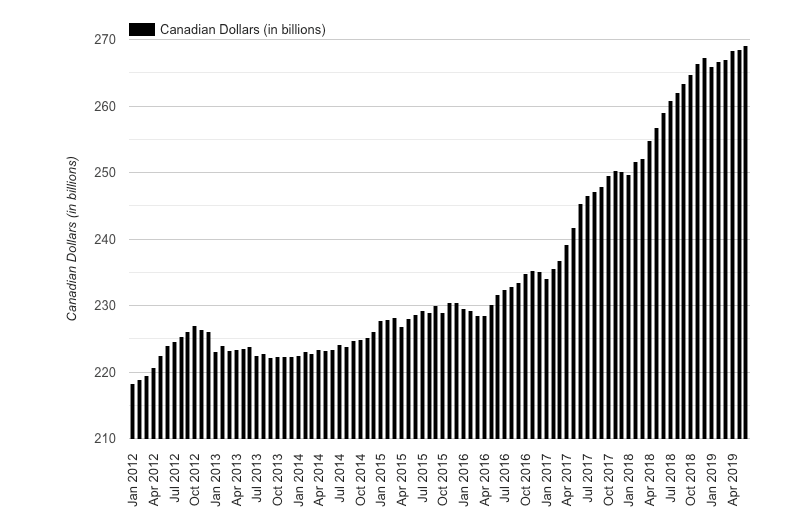

Personal Loans Secured By Real Estate Reaches Over $269 Billion

Most of the loans secured by residential real estate is for personal purposes. Personal loans secured by real estate reached $269.06 billion in June, up 0.19% from the month before. Compared to the same month last year, this number is 3.90% higher. Growth here is higher than usual, but is the lowest seen since March 2017, before the surge of growth.

Personal Loans Secured With Residential Real Estate

The total of personal loans, secured with residential real estate.

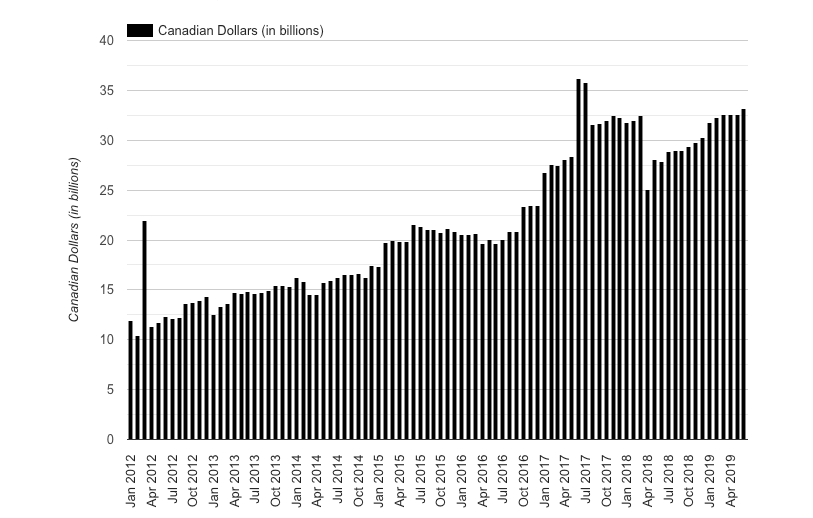

Over $33 Billion Of The Total Debt Is For Business Loans

If you were wondering what was behind the majority of the growth, it was because of business loans that were secured by residential real estate. Loans for business purposes took a total of $33.17 billion CAD of the total in June, this up 1.66% month-over-month. Compared year-over-year this number is 19.12% higher, this may seem very shocking however, this is compared to a year with no to low growth.

Business Loans Secured With Residential Real Estate

The total of business loans, secured with residential real estate.

Canadians are still scooping HELOC debt, but not quite at the pace of the frenzy. Personal growth has been slowing, helping to moderate total growth. However, they’re still using their home equity to borrow at a much higher clip than normal.

If you would like to discuss and learn more HELOC debt effects to the Real Estate Market, you can meet and discuss with Matt Gul. Matt said in 2012 HELOC Debt was $240 Billion and property prices went up significantly since then. For some cities, the property prices have almost doubled like in Vancouver. Meanwhile, HELOC Debt Raised only $62 Billion or around 20%. Matt’s personal opinion is that, based on these numbers, we have a better situation than 2012. Also, if you are thinking about buying or selling your properties, please contact Matt Gul, who is a top luxury real estate agent situated in West Vancouver, who can help you with all of your needs. To contact Matt Gul please call him at 778.888.8888 or email him at matt@mattgul.com

Summarized by: Onur Gul on instagram at @onurguldrone