This year when you got your tax notices, and if your property has an assessed value of over $3,000,000 you were probably surprised on why you were paying such a high amount, even after paying your home tax you probably would still wonder why it has increased that severely.

Starting in 2019, the provincial government will apply an additional school tax for properties assessed at $3 million and over.

As announced in the province's 2018 budget, this additional school tax will be applied to all residential properties in the province valued at $3 million and above, including:

· Single-family homes

· stratified condominium or townhouse units

· most vacant land

The additional tax rate is:

· 0.2% on the residential portion assessed between $3 million and $4 million

· 0.4% on the residential portion assessed at over $4 million

For mixed-use properties, only the residential portion of the property’s assessed value above $3 million will be taxable.

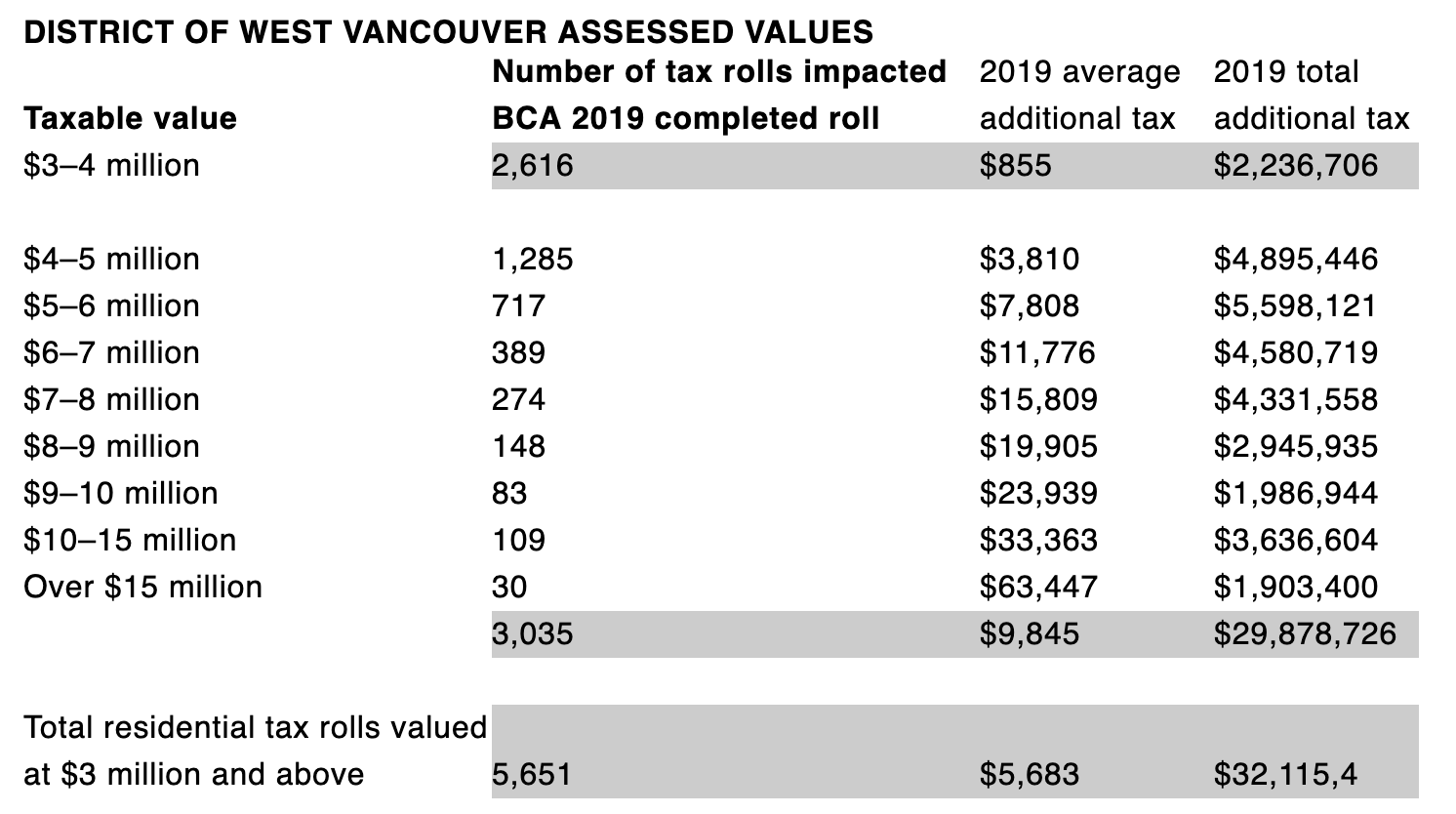

IMPACT ON WEST VANCOUVER

The table below provides updated estimates based on the 2019 completed roll received from the BC Assessment Authority. The value of many of these properties is being appealed, and the appeal process should be completed by the end of March 2019. At that time, the BC Assessment Authority will issue a revised roll for 2019, and these numbers will be updated.

If you think your house assessment is incorrect and would like to learn how to correct it, or if you are thinking about buying or selling your properties, please contact Matt Gul, who is a top luxury real estate agent situated in West Vancouver, who can help you with all of your needs. To contact Matt Gul please call him at 778.888.8888 or email him at matt@mattgul.com

Article Written by: Onur Gul on instagram at @onurguldrone